Loading

Get Irs 1040 - Schedule D 2011

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule D online

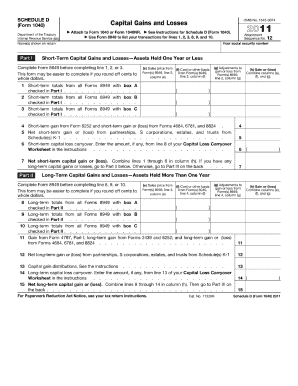

Filling out the IRS 1040 - Schedule D can be a straightforward process if you understand its components and steps. This guide will help you navigate through each section of the form and provide easy instructions to complete it online.

Follow the steps to fill out your IRS 1040 - Schedule D effectively.

- Click ‘Get Form’ button to obtain the IRS 1040 - Schedule D and open it in the editor.

- Familiarize yourself with the sections of Schedule D, which include short-term capital gains and losses and long-term capital gains and losses. You'll need to complete Form 8949 for transactions before entering totals on Schedule D.

- Start with Part I for short-term capital gains. Enter the totals from your Form 8949 based on your sales transactions for assets held one year or less in the respective line items.

- For each transaction, input the proceeds from sales, cost or other basis, and any adjustments to gain or loss as indicated in the fields under Part I.

- After calculating the net short-term capital gain or loss on line 7 by combining lines 1 through 6, transition to Part II for long-term capital gains. Complete Form 8949 for long-term transactions as well.

- Enter the totals from Form 8949 for long-term gains and losses in the appropriate line items of Part II.

- Combine the net long-term gain or loss from lines 8 through 14 to complete line 15, and then proceed to Part III.

- In Part III, summarize your total capital gain or loss on line 16 by adding the net short-term and long-term totals.

- Follow the subsequent instructions based on whether your result on line 16 is a gain, loss, or zero, and complete any necessary tax worksheets.

- Once all sections have been filled out, review your information carefully and then save your changes, download the completed form, print it out, or share it as needed.

Complete your IRS 1040 - Schedule D online with confidence and accuracy.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You may need to file the IRS 1040 - Schedule D if you sold your house and realized a capital gain. However, if your gain falls within the excluded amount for primary residences, you do not have to report it. It's essential to determine your specific situation before filing. Platforms like uslegalforms can help clarify whether you need to file based on your circumstances.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.