Loading

Get Irs 1040 - Schedule C-ez 2017

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule C-EZ online

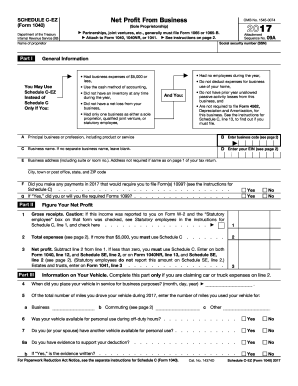

Filing your taxes can be a daunting task, but completing the IRS 1040 - Schedule C-EZ is a straightforward process designed for individuals with simple business income. This guide provides clear, step-by-step instructions to help you complete the form effectively and accurately.

Follow the steps to fill out your Schedule C-EZ online.

- Press the 'Get Form' button to access the Schedule C-EZ form and open it in your preferred editor.

- Enter your name as the proprietor in the designated field at the top of the form.

- Provide your business code by referring to the list found in the instructions page.

- If applicable, fill out the business name section; if you do not have a separate business name, leave this blank.

- Complete the business address section, ensuring to include the street number, city, and ZIP code.

- Indicate whether you made any payments requiring you to file Form 1099 and answer accordingly.

- Input your gross receipts from your business on line 1, ensuring you include all taxable income.

- Record total deductible business expenses on line 2; these should not exceed $5,000.

- Calculate and enter your net profit by subtracting total expenses from gross receipts on line 3.

- If claiming car or truck expenses, complete Part III by entering vehicle usage information as specified.

- Once all sections are complete, review your form for any errors and ensure all necessary information is included.

- Finally, save your changes, and download, print, or share your completed Schedule C-EZ form.

Start filling out your IRS 1040 - Schedule C-EZ online today to ensure a smooth tax filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To fill out the IRS 1040 - Schedule C-EZ, start by entering your business income and any allowable expenses. Follow the straightforward format, which requires less detail than the full Schedule C. You can find easy-to-follow instructions on platforms like uslegalforms to ensure accuracy in your filings.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.