Loading

Get Irs 1040 - Schedule C 2011

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule C online

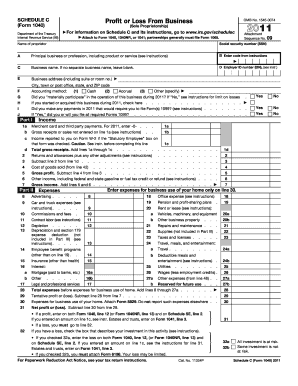

This guide provides clear instructions on how to complete the IRS 1040 - Schedule C form online, specifically designed for users with varying levels of experience. Schedule C is essential for reporting profit or loss from a business operated as a sole proprietorship.

Follow the steps to successfully complete and file Schedule C online.

- Click ‘Get Form’ button to obtain the Schedule C form and open it in the online editor.

- Enter your name as the proprietor in the designated field. This should be your legal name.

- In the section for principal business or profession, describe your business's main activities along with the products or services offered.

- If applicable, enter your business name in the 'Business name' field. If no separate name exists, leave it blank.

- Fill in your business address, including room or suite number, city, state, and ZIP code.

- Choose your accounting method by selecting Cash, Accrual, or Other, as relevant to your business operations.

- Complete Part I: Input your income details, including gross receipts and any other adjustments needed.

- Report all applicable expenses, such as advertising, car and truck expenses, contract labor, and rent or lease costs.

- If you have expenses related to the business use of your home, be sure to follow the instructions and attach Form 8829 if necessary.

- Finalize and review all entries for accuracy, then save your changes, download, print, or share the completed form as needed.

Ready to complete your IRS forms online? Start now and ensure your tax documents are accurately filed.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To calculate your income on the IRS 1040 - Schedule C, sum up all your sales and service income, then subtract your total business expenses. Ensure to include all revenue streams related to your business. This straightforward calculation helps you understand your profit or loss for the year.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.