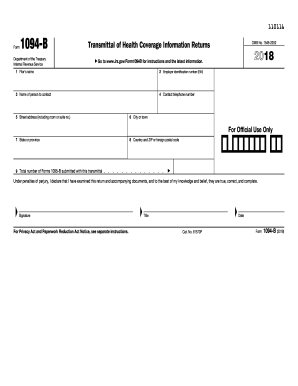

Get Irs 1094-b 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1094-B online

How to fill out and sign IRS 1094-B online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When the tax filing period begins unexpectedly or you simply overlook it, it might lead to complications for you. IRS 1094-B is not the simplest form, but there’s no need to worry in any case.

Utilizing our robust online software will help you learn how to complete IRS 1094-B even in times of severe time constraints. The only requirement is to adhere to these basic guidelines:

With our comprehensive digital solution and its specialized tools, completing IRS 1094-B becomes easier. Don't hesitate to try it and dedicate more time to your hobbies instead of file preparation.

Access the document using our powerful PDF editor.

Input all the necessary details in IRS 1094-B, using the fillable fields.

Insert images, marks, check boxes, and text boxes, if required.

Repeated information will be automatically populated after the initial entry.

If you encounter any challenges, activate the Wizard Tool. You'll receive helpful hints for simpler completion.

Always remember to include the filing date.

Create your unique electronic signature once and place it in all required locations.

Review the information you've entered. Rectify any errors if needed.

Click Done to finalize edits and select your delivery method. You can utilize virtual fax, USPS, or email.

You can also download the file for later printing or upload it to cloud storage services like Dropbox, OneDrive, etc.

How to modify Get IRS 1094-B 2018: personalize forms online

Experience a hassle-free and paperless method of working with Get IRS 1094-B 2018. Utilize our dependable online option and save significant time.

Creating each document, including Get IRS 1094-B 2018, from the ground up consumes too much time, so having a reliable solution of pre-prepared form templates can greatly enhance your productivity.

However, utilizing them can pose difficulties, particularly regarding documents in PDF format. Fortunately, our comprehensive collection features a built-in editor that enables you to swiftly complete and personalize Get IRS 1094-B 2018 without departing from our site, allowing you to avoid wasting valuable time while finalizing your documents. Here's what you can do with your file using our solution:

Whether you need to execute editable Get IRS 1094-B 2018 or any other template available in our library, you're on the correct path with our online document editor. It's straightforward and secure and doesn’t necessitate a specific technical background. Our web-based tool is designed to handle nearly all aspects you might consider regarding document editing and execution.

Eliminate the antiquated method of managing your documents. Opt for a professional solution to assist you in streamlining your tasks and reducing reliance on paper.

- Step 1. Find the necessary form on our platform.

- Step 2. Hit Get Form to open it in the editor.

- Step 3. Take advantage of professional editing capabilities that let you insert, delete, annotate, and emphasize or obscure text.

- Step 4. Create and attach a legally-binding signature to your document using the sign option from the top toolbar.

- Step 5. If the template layout isn’t as you desire, utilize the features on the right to eliminate, add, and rearrange pages.

- Step 6. Add fillable fields so others can be invited to finish the template (if pertinent).

- Step 7. Distribute or email the document, print it, or choose the format in which you wish to receive the file.

Get form

Related links form

Form 1094-C is used by applicable large employers to report employee health coverage to the IRS. It includes details about the health plans offered and the employees who accepted the coverage. This form is essential for compliance with the Affordable Care Act and is separate from the IRS 1094-B, which serves different reporting needs.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.