Loading

Get Irs 1040 - Schedule B 2012

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule B online

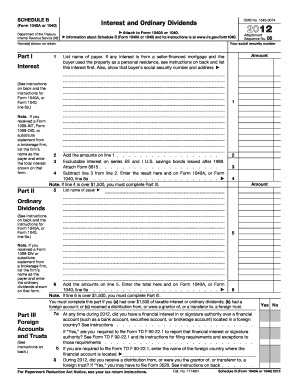

Filling out the IRS 1040 - Schedule B is essential for reporting interest and ordinary dividends. This guide provides a step-by-step approach to help users complete the form accurately and efficiently online.

Follow the steps to effectively complete Schedule B.

- Press the ‘Get Form’ button to obtain the IRS 1040 - Schedule B and open it for editing.

- In the 'Name(s) shown on return' section, enter your name and the names of any other individuals included on the tax return.

- Part I focuses on interest. For line 1, list each payer's name and the amount of taxable interest received. If applicable, include interest from seller-financed mortgages, showing the buyer’s information.

- Add all amounts from line 1, and enter the total on line 2.

- If you received interest from series EE or I U.S. savings bonds, complete line 3 using Form 8815 for possible exclusions.

- Enter the total of taxable interest on line 4. If the total is over $1,500, proceed to Part III.

- In Part II, report your ordinary dividends in line 5, including the payer's name and the amount. If received as a nominee, follow the same reporting procedure.

- Sum all amounts in line 5 and enter the total on line 6.

- Proceed to Part III if you have over $1,500 in taxable interest or dividends or any foreign accounts.

- For line 7a, check 'Yes' or 'No' based on your financial interests in foreign accounts, as instructed.

- If required, complete line 7b by specifying the foreign country of the financial account.

- For line 8, report any distributions from foreign trusts, ensuring to keep accurate records.

- After completing all sections, save your changes. You can then choose to download, print, or share the completed Schedule B.

Begin filling out your IRS 1040 - Schedule B online today to ensure accurate reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The new IRS 1040 form for seniors simplifies the tax filing process by incorporating age-related benefits and deductions. It is designed to cater to the unique financial situations that many seniors face. If you need assistance navigating these changes or filing your IRS 1040 - Schedule B, platforms like USLegalForms can provide helpful resources.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.