Loading

Get Irs 1065 2011

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1065 online

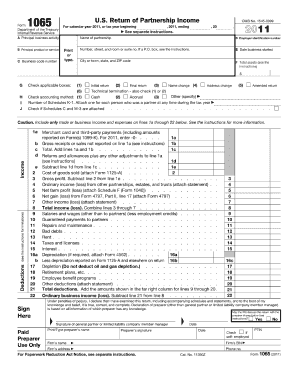

Filling out the IRS 1065 form is essential for partnerships reporting their income, deductions, and credits. This guide provides step-by-step instructions for completing the form online, ensuring an accurate and efficient submission process.

Follow the steps to successfully complete the IRS 1065 online.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Enter the principal business activity and the business code number in the designated fields at the top of the form.

- Fill in the name of the partnership and the employer identification number (EIN).

- Provide the business start date and the total assets as required.

- Check the applicable boxes for the return type (initial, final, name change, etc.) and note the accounting method (cash or accrual).

- List the number of Schedules K-1 attached, ensuring to include one for each partner during the tax year.

- Complete the income section by detailing gross receipts and any adjustments to income as specified.

- Fill out the deductions section, including salaries, cost of goods sold, and other applicable deductions.

- In the Signature section, ensure a general partner or limited liability company member manager signs the form.

- Review all entries for completeness and accuracy, save changes, and either download, print, or share the completed form.

Start filling out your IRS 1065 form online today for a smooth filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The IRS 1065 form is a tax return specifically designed for partnerships to report income, deductions, and other financial activities. This form allows partners to report their share of the income and expenses on their individual tax returns. Understanding the IRS 1065 form is essential for compliance and effective business management.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.