Loading

Get Irs 1040 - Schedule A 2012

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule A online

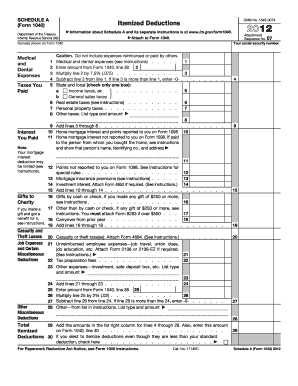

Filling out the IRS 1040 - Schedule A online can be a straightforward process with the right guidance. This form allows individuals to itemize their deductions, potentially reducing their taxable income and maximizing their refund.

Follow the steps to successfully complete your Schedule A online.

- Click ‘Get Form’ button to access the IRS 1040 - Schedule A form and view it in your preferred editor.

- Enter your name(s) as shown on Form 1040 at the top of the Schedule A. This ensures that your deductions are correctly linked to your tax return.

- Begin with section for medical and dental expenses. Report the total amount of these expenses on line 1. Be sure not to include any expenses reimbursed or paid by others.

- For line 2, calculate 7.5% of the amount from line 1 and enter that value. On line 3, subtract the amount from line 2 from line 1. If your line 3 result is negative, enter zero.

- In the taxes paid section, check one box to indicate if you paid state and local income taxes (line 5) or general sales taxes (line 6). Then list any real estate taxes on line 6 and personal property taxes on line 7.

- Add the amounts from lines 5 through 8 and enter the total on line 9.

- In the home mortgage interest section, report the total mortgage interest you paid that was reported on Form 1098 on line 10. Additionally, include any interest not reported on Form 1098 on line 11.

- List points not reported to you on Form 1098 on line 12. If applicable, enter mortgage insurance premiums on line 13 and any investment interest on line 14. Sum these on line 15.

- In the gifts to charity section, record any cash or check donations on line 16. For gifts other than cash or check, list them on line 17.

- If you have any casualties or theft losses, include the amount on line 20. Ensure that you attach Form 4684 as required.

- For job expenses, report any unreimbursed employee expenses on line 21, and ensure you attach Form 2106 or 2106-EZ if needed.

- Add any tax preparation fees or other miscellaneous deductions to lines 22 and 23, and calculate the total on line 24.

- Complete the final calculations by totaling all amounts from lines 4 through 28 on line 29, and then transfer this amount to Form 1040, line 40.

- If you decide to itemize deductions that are below the standard deduction limit, check the box on line 30.

- Finally, review your completed form, save any changes, and download a copy if needed. Prepare to print or share your Schedule A as required.

Start filling out your IRS 1040 - Schedule A online today for a smoother tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Schedule A allows taxpayers to list their medical expenses that exceed a certain percentage of their adjusted gross income. This can include a variety of costs such as hospital bills, insurance premiums, and some long-term care expenses. Reviewing these expenses closely can potentially lead to significant deduction opportunities.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.