Loading

Get Irs 941-v 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 941-V online

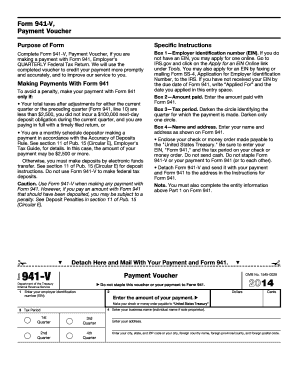

Filling out the IRS 941-V, Payment Voucher, is an essential step when making a payment alongside Form 941, Employer’s Quarterly Federal Tax Return. This guide provides easy-to-follow instructions to ensure your payment is processed accurately and efficiently.

Follow the steps to complete the IRS 941-V online

- Press the ‘Get Form’ button to access the form and open it in the editing interface.

- In Box 1, enter your employer identification number (EIN). If you do not have an EIN, you can apply for one online or by fax or mail with Form SS-4, Application for Employer Identification Number.

- In Box 2, specify the amount you are paying with Form 941. Ensure that this figure accurately reflects your payment to avoid any discrepancies.

- In Box 3, select the quarter for which you are making the payment by darkening the corresponding circle. Only one circle should be marked.

- In Box 4, input your name and address exactly as it appears on Form 941. This consistency helps the IRS match your voucher with your submission.

- Prepare your payment by enclosing a check or money order made out to the 'United States Treasury.' On the payment, include your EIN, 'Form 941,' and the corresponding tax period to ensure it is credited correctly.

- Detach the completed Form 941-V and send it along with your payment and Form 941 to the address specified in the Instructions for Form 941. Avoid stapling the voucher or your payment to the form.

- Once you have entered all necessary information and attached your payment, save the changes. You may download or print the completed form for your records or future reference.

Complete your IRS 941-V and ensure your payment is made seamlessly online.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To change the filing method of your Federal Forms to e-file: You may now e-file forms 940, 941, and 944 in QuickBooks Desktop using your existing 10-digit PIN. In QuickBooks Desktop, go to Employees > Payroll Center. ... Check if the filing method of your Federal Form 940, 941 and 944 is already E-File and click Continue.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.