Loading

Get Irs Ss-4 2001

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS SS-4 online

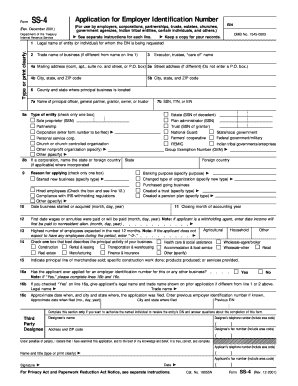

Filing for an Employer Identification Number (EIN) using Form SS-4 is a crucial step for various entities, including businesses and trusts. This guide outlines how to complete the SS-4 form online methodically and efficiently.

Follow the steps to fill out the IRS SS-4 form online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Enter the legal name of the entity or individual requesting the EIN in line 1. Ensure that the name matches official documents for accuracy.

- If applicable, provide the trade name of the business in line 2. This is only needed if it differs from the legal name you provided earlier.

- Complete the executor, trustee, or 'care of' name in line 3, if relevant.

- Fill in the mailing address in line 4a, including the room, apartment, suite number, street, or P.O. box. For line 5a, if there is a different street address, please specify.

- Indicate the county and state where the principal business is located in line 6.

- Fill in the city, state, and ZIP code for the principal business address in line 4b.

- Select the appropriate type of entity in line 7 by checking only one box.

- If applicable, provide the social security number, individual taxpayer identification number, or previously assigned EIN.

- State the reason for applying for an EIN in line 10 by checking one box that best describes your business situation.

- Complete the remaining sections, including expected number of employees, principal activities, and any previous EIN details in lines 12-16.

- Designate a third-party designee in the final section if you want to authorize someone to receive the EIN and discuss the application.

- Review the entire form for accuracy, ensure all signatures are provided, and date the application. Finally, save your changes, and you may download, print, or share the completed form.

Start filling out your IRS SS-4 form online today to obtain your EIN.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To check the status of your EIN number, you can contact the IRS directly. They can provide you with the necessary information and clarify any concerns you might have. Alternatively, the uslegalforms platform offers tools that help you track and manage your EIN-related tasks seamlessly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.