Loading

Get Fms 5599 2010-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FMS 5599 online

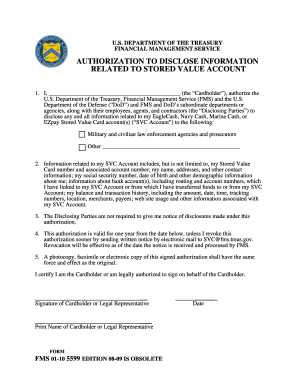

The FMS 5599 form is crucial for authorizing the disclosure of information related to your stored value account, such as EagleCash or Navy Cash. This guide provides detailed, step-by-step instructions to assist you in completing the form efficiently and accurately in an online format.

Follow the steps to complete the FMS 5599 online effectively.

- Click the ‘Get Form’ button to access the form and open it for editing.

- In the first section, enter the name of the cardholder in the space provided; ensure accuracy to avoid processing issues.

- Specify the parties to whom you authorize disclosure of your stored value account information by listing military and civilian law enforcement agencies as well as any other entities.

- Review the information related to your stored value account, ensuring you understand what is included, as it encompasses sensitive personal data.

- Acknowledge that the disclosing parties are not required to notify you of disclosures.

- Indicate the authorization validity period, which is one year from the date you sign, and include the date.

- Provide your signature or that of a legal representative, along with the printed name of the signer.

- Finalize the process by saving changes, downloading, printing, or sharing the completed form as appropriate.

Complete your FMS 5599 form online today to ensure your information is handled with authority.

Related links form

To fill out a W9 form properly, begin by entering your name and business information accurately. Make sure to check the appropriate box for your tax classification and provide your taxpayer identification number. For further assistance and guidance on the W9 form, consider using the FMS 5599 platform to ensure you follow all requirements effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.