Loading

Get De Wcwt-5 - Wilmington 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DE WCWT-5 - Wilmington online

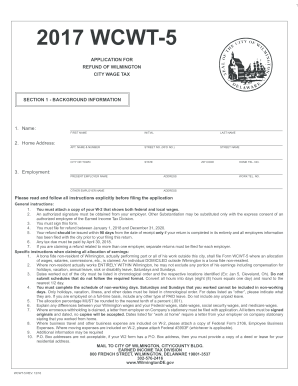

Filling out the DE WCWT-5 form online for a refund of Wilmington city wage tax is a straightforward process. This guide provides clear, step-by-step instructions to ensure you complete the form correctly and efficiently.

Follow the steps to fill out your DE WCWT-5 online.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Begin with Section 1, providing your background information. Enter your first name, middle initial, and last name as prompted, along with your street address, city or town, state, and zip code. Also, include your home telephone number.

- Continue to fill in your employment details. Provide your current employer's name and address, as well as any other employers you have worked for, including their respective addresses and work telephone numbers.

- Carefully read and follow all the general instructions provided with the form. Ensure that you attach a copy of your W-2 form for the applicable year.

- Move on to Section 2, where you will compute your refund. Start with your gross earnings for the year and provide the necessary figures for overtime, both inside and outside Wilmington, as applicable.

- Calculate the allocation percentage and identify any non-taxable earnings. Make sure to round the allocation percentage to the nearest tenth of a percent.

- In this section, also indicate any differences between your Wilmington wages and your federal, state, social security, and Medicare wages.

- Proceed to Section 3 for employer certification. An authorized official from your employer must provide their signature and contact information to verify the details listed in the application.

- Finally, review your form for accuracy before submission. Ensure you save your changes, and consider downloading or printing a copy for your records.

Complete your DE WCWT-5 online today to ensure a smooth tax refund process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, Delaware is considered a tax-friendly state for retirees. The state does not tax Social Security benefits and offers favorable tax rates for other forms of retirement income. If you plan to retire in Wilmington, DE, you will likely find its tax structure beneficial. Explore options on the USLegalForms platform for better insight into retirement tax strategies.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.