Loading

Get Ri Dot Ri-w3 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RI DoT RI-W3 online

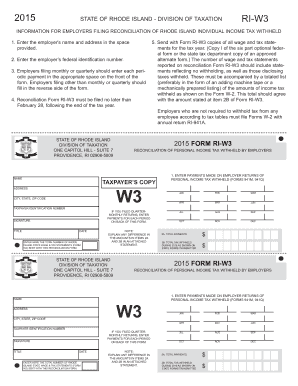

Filling out the RI DoT RI-W3 form online is essential for employers to report income tax withheld from employees. This comprehensive guide provides clear, step-by-step instructions to ensure accurate completion of the form.

Follow the steps to successfully complete the RI DoT RI-W3 form.

- Click ‘Get Form’ button to obtain the RI DoT RI-W3 form and open it in your preferred document editor.

- In the first section, enter the employer's name and complete address exactly as it appears in official records.

- Provide the employer's federal identification number in the designated field.

- For employers filing monthly or quarterly, enter each periodic payment for the tax year in the appropriate boxes on the front of the form. If your filing frequency is different, please fill out the appropriate sections on the back of the form.

- Ensure the RI-W3 form is submitted no later than February 28, following the end of the tax year.

- Include copies of all wage and tax statements for the tax year with your submission. This includes the state tax department copy of the approved alternate form or Copy I of the six-part optional federal form.

- Enter the total number of Rhode Island State Wage & Tax Statements (Form W-2) that are being sent with this reconciliation form.

- At the end of the form, review to ensure all calculated amounts align with the total reported on item 2B of Form RI-W3, representing total tax withheld during the year.

- Lastly, provide your signature, the date, and your title in the designated fields at the bottom of the form.

Complete your RI DoT RI-W3 form online today to ensure compliance with Rhode Island tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Rhode Island does tax income earned by its residents, regardless of where it is sourced. This includes wages from jobs out of state, which must be reported on state tax filings. When completing your state documents, including the RI DoT RI-W3, ensure accurate representation of all income earned to avoid complications.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.