Loading

Get Mo Form E-1r 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO Form E-1R online

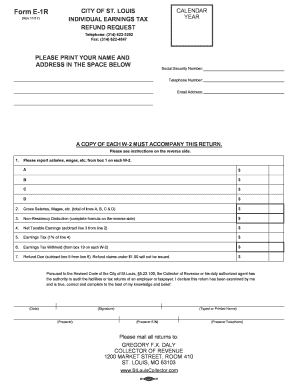

Filling out the MO Form E-1R online is an essential step for individuals seeking a refund of their earnings tax based on days worked outside the City of St. Louis. This guide will provide clear, step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal details. Print your name and address in the designated space. Ensure your Social Security number, telephone number, and email address are accurately filled out.

- Acquire copies of each W-2 that you need to include with your request. According to the instructions, salaries, wages, and other relevant earnings must be reported from box 1 of each W-2. Input the amounts in the corresponding boxes labeled A, B, C, and D.

- Calculate the total of lines A, B, C, and D and enter this sum in box 2 under 'Gross Salaries, Wages, etc.'

- Complete the non-residency deduction formula as indicated on the reverse side of the form. Document the days worked outside the city according to the required details.

- Subtract line 3 (Non-Residency Deduction) from line 2 (Gross Salaries, Wages) to derive your net taxable earnings, and input this figure in box 4.

- Calculate your earnings tax, which is 1% of the net taxable earnings from line 4, and enter that amount in box 5.

- Input the total earnings tax withheld from box 19 on each W-2 into box 6.

- Finally, subtract line 5 (Earnings Tax) from line 6 (Earnings Tax Withheld) to compute your refund due, and enter this amount in box 7. Note that refund claims under $1.00 will not be issued.

- Complete the declaration at the bottom of the form, including your signature, date, typed name, and preparer's information if applicable. It is crucial to review the form for accuracy before submission.

- Once completed, users can save changes, download, print, or share the form as necessary.

Complete your documents online today to ensure a smooth filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The form mo nri pertains to non-residents filing tax returns in Missouri. This form ensures that non-residents comply with state tax laws while reporting their income. If you require the MO Form E-1R or any related documents, US Legal Forms can assist you in navigating the requirements needed for your tax filings.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.