Loading

Get In Bt-1 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN BT-1 online

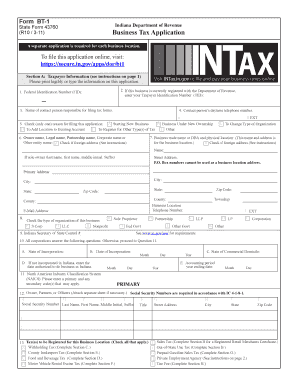

Filling out the IN BT-1 form is an essential process for businesses registering with the Indiana Department of Revenue. This guide provides a step-by-step approach to ensure accuracy and compliance when submitting your application online.

Follow the steps to successfully complete the IN BT-1 online application.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your Federal Identification Number (FID) on line 1 of Section A. This number is crucial if your business qualifies and is required to report federal taxes.

- If your business is already registered, provide your Taxpayer Identification Number (TID) on line 2. If not, you can skip this step.

- Complete lines 3 and 4 by entering the full name and daytime phone number of the contact person responsible for tax filings.

- Select one reason for filing this application from line 5. Ensure that you only check one box to avoid confusion.

- On line 6, enter the legal name of the business or owner, and check if it is a foreign address if applicable.

- Fill in the business trade name or DBA and physical address on line 7 to ensure proper registration.

- Indicate the type of organization on line 8 by selecting the appropriate option for your business structure.

- If applicable, complete lines 10 and 11 regarding details about your corporation and enter the primary NAICS code on line 11.

- In line 12, provide the required Social Security Numbers along with the names and titles for owners, partners, or corporate officers.

- On line 13, mark the tax types you are registering for by checking all applicable boxes.

- Once all sections are filled out accurately, save your changes, download, print, or share the form as necessary.

Complete your application online today and ensure your business is properly registered with the Indiana Department of Revenue.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The WH-1 form in Indiana is a crucial document for employers who need to register for withholding tax. This form collects necessary information about your business and employee withholdings. Accurate completion of the WH-1 helps ensure compliance with Indiana tax regulations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.