Loading

Get Ar Dfa Ar3mar 2006

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR DFA AR3MAR online

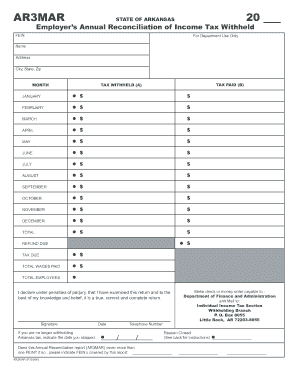

Filling out the AR DFA AR3MAR form is an essential part of employer tax compliance in Arkansas. This guide provides a clear, step-by-step approach to completing the form online, ensuring accuracy and ease throughout the process.

Follow the steps to successfully complete the AR DFA AR3MAR form online.

- Use the ‘Get Form’ button to obtain the AR DFA AR3MAR form and launch it in your document editor.

- Enter the tax year in the space provided at the top of the form, where indicated.

- Fill in your Federal Employer Identification Number (FEIN) in the designated field.

- In the sections labeled 'Name,' 'Address,' 'City, State, Zip,' input your business contact information.

- For each month, enter the amount of Arkansas tax withheld in Column A and the net tax amount paid in Column B.

- Calculate the total amount of taxes withheld for the year and enter this in the appropriate box.

- List the total wages paid and the total number of employees in the boxes provided.

- If the tax paid exceeds the tax withheld, fill in the refund amount; if not, enter the tax due amount.

- Include the date you ceased withholding Arkansas taxes, if applicable, and the reason for closure.

- Review all entries for accuracy and completeness.

- Once confirmed, save your changes, and download, print, or share the completed form as required.

Complete your AR DFA AR3MAR form online today to ensure compliance and timely tax filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You certainly can file Arkansas state taxes online using the AR DFA AR3MAR. This user-friendly system streamlines the process, making it accessible to everyone. By choosing to file online, you not only save time but also reduce the chance of errors in your tax return. For guidance on this process and to find necessary forms, you may want to explore the resources available through uslegalforms.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.