Loading

Get Mn Dor St3 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR ST3 online

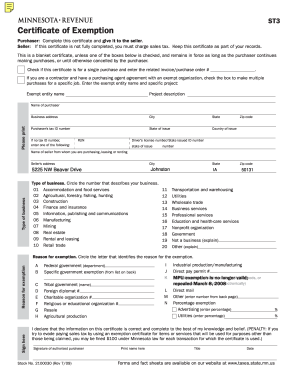

The MN DoR ST3 form, known as the Certificate of Exemption, allows purchasers to claim exemptions from sales tax under specific circumstances. This guide will provide comprehensive step-by-step instructions to assist users in filling out the form correctly online.

Follow the steps to complete the MN DoR ST3 form online efficiently.

- Click 'Get Form' button to obtain the certificate and open it in the editor.

- In the 'Purchaser' section, fill in your name and business address. Ensure that you complete all fields, including city, state, tax ID number, and zip code.

- Indicate whether this certificate is for a single purchase by checking the appropriate box and entering the related invoice or purchase order number, if applicable.

- If applicable, indicate if you are a contractor with a purchasing agent agreement. Check the box for multiple purchases and provide the exempt entity name and project description.

- Complete the 'Seller Information' section by entering the seller's name, address, city, and type of business.

- Circle the number that best describes the type of business you are involved in from the provided list, ensuring it corresponds accurately to your business activities.

- In the 'Reason for exemption' section, circle the corresponding letter that identifies your reason for claiming exemption and fill in any additional necessary details.

- Sign the certificate as the authorized purchaser and print your name, title, and date of signing accurately.

- Finally, save your changes, then download and print the completed form for your records. Ensure to share the completed certificate with the seller, but do not send it to the Department of Revenue.

Complete your MN DoR ST3 form online today to ensure your purchases are processed correctly!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The ST3 form MN, known as the MN DoR ST3, is a crucial document for businesses in Minnesota seeking to buy goods without incurring sales tax. This form acts as a certification that the purchaser qualifies for tax exemption due to their business operations, typically for resale purposes. Understanding and using the ST3 correctly can significantly improve financial efficiency for businesses.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.