Loading

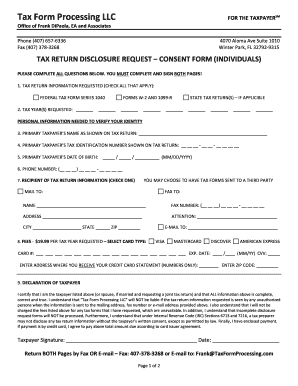

Get Tax Return Disclosure Request - Consent Forms - Individuals

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Return Disclosure Request - Consent Forms - Individuals online

Filling out the Tax Return Disclosure Request - Consent Forms - Individuals allows you to authorize the disclosure of your tax return information. This guide will walk you through the process of completing the form online, ensuring all necessary details are provided accurately.

Follow the steps to successfully complete your Tax Return Disclosure Request

- Click ‘Get Form’ button to access the form and open it in the designated online editor.

- Review the section titled ‘Tax Return Information Requested’ and check all relevant boxes for the federal tax form series 1040, any requested tax years, W-2, 1099-R, and state tax returns, if applicable.

- Provide your personal information in the ‘Personal Information Needed to Verify Your Identity’ section. Fill in your name as shown on your tax return, your tax identification number, date of birth, and phone number.

- Indicate the recipient of the tax return information by checking the appropriate box for mailing, faxing, or emailing. Fill in the necessary contact details including name, fax number, address, attention line, city, state, and zip code.

- Complete the payment section by selecting your card type and entering your card number, expiration date, CVV, and billing address details. Ensure all required fields are filled out to avoid processing issues.

- Carefully read the ‘Declaration of Taxpayer’ section, ensuring that all information you provided is complete and accurate. Sign and date the form to confirm your understanding and consent.

- Finally, ensure both pages of the form are completed. You can then save any changes, download, and print the form. Return both pages via fax or email as indicated.

Start completing your Tax Return Disclosure Request - Consent Forms - Individuals online today.

To cancel your TurboTax Subscription, follow these easy steps: Log into your account. Go to 'TurboTax Advantage' on the right hand panel. Select 'Remove Product' next to the subscription(s) you wish to cancel. Answer the follow up prompts to confirm.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.