Loading

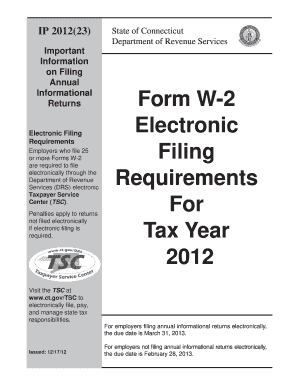

Get Form W-2 Electronic Filing Requirements 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W-2 Electronic Filing Requirements online

Filing Form W-2 electronically is a requirement for employers submitting 25 or more forms. This guide offers a clear, step-by-step approach to completing this process online, ensuring compliance with the Department of Revenue Services regulations.

Follow the steps to complete the Form W-2 electronically.

- Click ‘Get Form’ button to obtain the Form W-2 Electronic Filing Requirements and open it in your preferred format.

- Read through the general instructions thoroughly to understand the filing requirements, including submission deadlines and the importance of electronically filing if you have 25 or more Forms W-2.

- Identify your Employer Identification Number (EIN) and Connecticut Tax Registration Number (CT REG) as these are essential for completion.

- Fill out the Submitter Record section, entering the necessary details such as the submitter's name, contact information, and the federal Employer Identification Number.

- Proceed to the Employer Record section where you will input information regarding the employer's name and address, as well as the identification numbers.

- Complete the State Record for Connecticut, ensuring to input accurate social security numbers, names, and wage information for each employee.

- After filling out all necessary records, generate the Total Record to summarize the information provided.

- Finalize by creating the Final Record to indicate the end of your submission. Ensure no data follows this record.

- Review all entries for accuracy and completeness before finalizing the electronic submission to the Department of Revenue Services.

- Once completed, you may save changes, download a copy for your records, or share the form as needed.

Start your electronic filing process today and ensure compliance with the Form W-2 requirements!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The minimum earnings for a W-2 do not have a specific threshold; however, any employee earning wages must receive a W-2 at the end of the year regardless of amount. If your earned income exceeds $600, ensure you file taxes accordingly. Understanding the Form W-2 Electronic Filing Requirements can help you manage your filings correctly, and US Legal Forms can provide the necessary templates and guidance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.