Loading

Get Ct Reg-8 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT REG-8 online

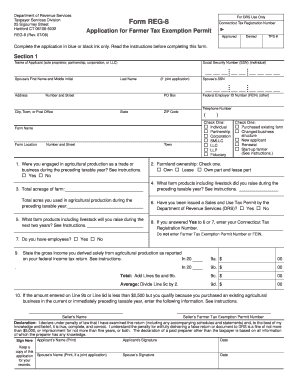

The CT REG-8 is a crucial form for individuals or entities applying for the Farmer Tax Exemption Permit in Connecticut. This guide provides step-by-step instructions to help you complete the form online effectively and accurately.

Follow the steps to successfully complete your CT REG-8 application.

- Press the ‘Get Form’ button to access the CT REG-8 form online, allowing you to fill it out in an editor that facilitates ease of use.

- Begin by entering your Social Security Number (SSN) if you are an individual, or the Federal Employer Identification Number (FEIN) if you are an organization.

- Provide the name of the applicant, ensuring that you specify whether it is a sole proprietor, partnership, corporation, or LLC.

- Fill in the address where the farm is located, including the number and street, city or town, state, and ZIP code.

- Select your status by checking the appropriate box: Individual, Partnership, Corporation, SMLLC, LLC, LLP, or Fiduciary.

- Enter the farm name and provide details about your agricultural production. Indicate if you were engaged in agricultural production during the preceding tax year by selecting 'Yes' or 'No'.

- State the total acreage of your farm and how many acres you used for agricultural production in the last tax year.

- List the types of farm products and livestock you plan to raise over the next two years.

- Respond to questions regarding farmland ownership by selecting one of the options: Own, Lease, or Both.

- Indicate whether you have been issued a Sales and Use Tax Permit by the Department of Revenue Services.

- Declare your gross income derived from agricultural production as reported on your federal income tax return, completing Lines 9a, 9b, and 9c.

- Complete Section 2 if you report farm income on federal Schedule C by detailing your sales and expenses.

- Review the declaration statement, sign and date the form, and ensure that you include your spouse's signature if applicable.

- Finally, save changes, and remember to download or print a copy of the completed form for your records.

Complete your CT REG-8 form online today for efficient processing of your application.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, Connecticut does accept amended returns electronically. This option simplifies correcting any errors in your original submission. By referencing CT REG-8, you can ensure you meet all requirements for filing amended returns. Uslegalforms can assist you in navigating this process smoothly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.