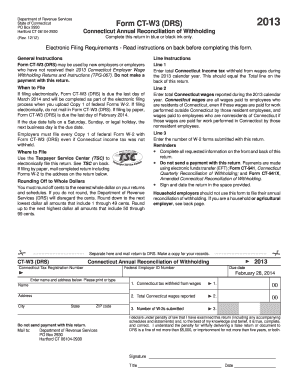

Get Ct Drs Ct-w3 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CT DRS CT-W3 online

How to fill out and sign CT DRS CT-W3 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If the tax timeframe commenced unexpectedly or perhaps you simply overlooked it, it might likely lead to difficulties for you. CT DRS CT-W3 is not the most straightforward, but you have no cause for concern in any case.

By utilizing our expert platform, you will learn how to complete CT DRS CT-W3 in scenarios of significant time constraints. All you need to do is adhere to these basic instructions:

With our comprehensive digital solution and its beneficial tools, submitting CT DRS CT-W3 becomes simpler. Don't hesitate to try it and enjoy more time on personal pursuits rather than handling paperwork.

Access the document using our professional PDF editor.

Complete the required information in CT DRS CT-W3, utilizing the fillable fields.

Add images, checkmarks, crosses, and text boxes if necessary.

Repetitive data will be populated automatically after the initial entry.

If you encounter any issues, employ the Wizard Tool. You will receive helpful advice for easier completion.

Always remember to include the filing date.

Create your unique signature once and place it in all required locations.

Review the included details. Amend errors if needed.

Click Done to conclude editing and choose your preferred submission method. You can opt for virtual fax, USPS, or email.

You have the option to download the file for later printing or upload it to cloud storage.

How to Update Get CT DRS CT-W3 2013: Personalize Forms Online

Explore a standalone solution to manage all your documentation seamlessly.

Locate, adjust, and complete your Get CT DRS CT-W3 2013 within a single interface with the assistance of intelligent tools.

The era when individuals had to print forms or manually write them is now behind us. In today's world, obtaining and completing any form, like Get CT DRS CT-W3 2013, merely requires opening a single web browser tab. Here, you can access the Get CT DRS CT-W3 2013 form and tailor it to your specifications, from inserting text directly into the document to sketching on a digital sticky note and attaching it.

Uncover tools that will ease your paperwork process with minimal effort.

Utilize Additional tools to personalize your form: Utilize Cross, Check, or Circle tools to denote the information in the document. Insert textual content or fillable fields with text customization options. Remove, Highlight, or Blackout text sections in the document using respective tools. Add a date, initials, or even an image to the document if required. Employ the Sticky note tool to comment on the form. Use the Arrow and Line, or Draw tool to introduce graphic elements to your document. Preparing Get CT DRS CT-W3 2013 paperwork will no longer be a hassle if you know where to find the right template and accomplish it effortlessly. Feel free to give it a try.

- Click the Get form button to quickly prepare your Get CT DRS CT-W3 2013 paperwork and begin editing immediately.

- In the editing mode, you can effortlessly fill in the template with your details for submission.

- Simply click on the field you wish to modify and input the information right away.

- The editor's interface is user-friendly and does not demand any specialized skills.

- Once you finish with the changes, review the information for accuracy one more time and sign the document.

- Click on the signature field and follow the instructions to electronically sign the form in no time.

Get form

Related links form

You can obtain your CT tax forms directly from the CT DRS website, which offers a variety of downloadable forms for different tax purposes. If you prefer a more comprehensive solution, platforms like US Legal Forms provide easy access to all necessary tax forms, including filing instructions that guide you through each step.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.