Loading

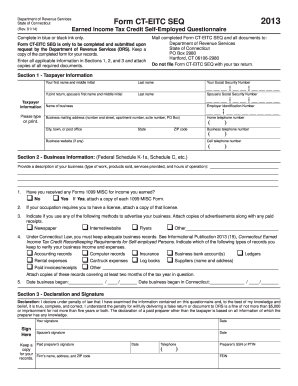

Get Ct Drs Ct-eitc Seq 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT DRS CT-EITC SEQ online

Filling out the CT DRS CT-EITC SEQ form is an important step for self-employed individuals seeking to claim the Earned Income Tax Credit in Connecticut. This guide will walk you through each section of the form to ensure that you provide the necessary information accurately and completely.

Follow the steps to complete the CT DRS CT-EITC SEQ form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Section 1, enter your personal details such as your first name, middle initial, last name, and Social Security Number. If applicable, include your spouse's information as well.

- Provide your business information: Name, mailing address, Employer Identification Number (EIN), and telephone numbers. Include the business website if you have one.

- Move to Section 2 and describe your business, including the type of work you do and products or services offered. Ensure to answer questions regarding receipt of Forms 1099 MISC and licenses.

- Indicate your advertising methods and attach any corresponding documents. Be thorough in your documentation regarding business records.

- For date fields, provide the dates for when your business began and when it began in Connecticut. This information is required for eligibility.

- In Section 3, read the declaration carefully, then provide your signature and date, along with the signature of your spouse if applicable. Ensure you include the signature of any paid preparer if someone assisted you with filling out the form.

- Finally, review all entered information for accuracy. Once complete, save the changes, and consider your options to download, print, or share the form as needed.

Complete your CT DRS CT-EITC SEQ form online today to take advantage of the Earned Income Tax Credit.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To enter the Earned Income Credit (EIC) on your tax return, locate the section for credits on your tax form. You will need to follow the instructions provided, which may direct you to fill out additional schedules. Ensure you conform with the guidelines of the CT DRS CT-EITC SEQ to avoid mistakes.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.