Loading

Get Ct Drs Cert-123 2005-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT DRS CERT-123 online

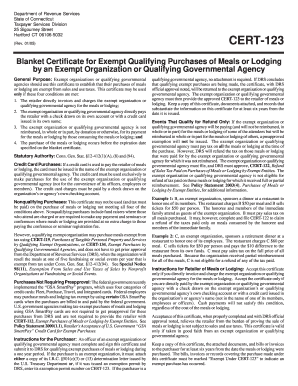

This guide provides detailed instructions on how to properly fill out the CT DRS CERT-123 form online. It is designed to be user-friendly and accessible for individuals regardless of their legal experience.

Follow the steps to complete the CT DRS CERT-123 online.

- Press the ‘Get Form’ button to access the form and open it in your editing tool.

- Indicate whether the form is for an exempt organization or a qualifying governmental agency by checking the appropriate box.

- Provide the federal employer identification number and address of the exempt organization or governmental agency.

- If applicable, enter the Connecticut exemption permit number. If not, attach the I.R.C. §501(c)(3) or (13) determination letter.

- Fill in the name and address of the retailer that will provide the meals or lodging.

- Check the boxes next to the types of service provided, either meals, lodging, or both.

- Describe the purpose or reason for the event, providing specific details about the occasion.

- Answer the questions regarding reimbursement and invoicing clearly with 'Yes' or 'No'.

- Complete the declaration section, affirming the conditions stated and ensuring all information is accurate.

- Sign and date the form where indicated, including your printed name, contact number, and title.

- Submit the completed form to the Department of Revenue Services for approval before use.

Complete your CT DRS CERT-123 online for efficient handling of qualifying exempt purchases.

Related links form

To obtain a reseller certificate in Connecticut, you must fill out the application available from the Department of Revenue Services. You will need to provide information about your business, including your tax identification number. With CT DRS CERT-123, you can navigate the application process smoothly, ensuring you have all necessary documentation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.