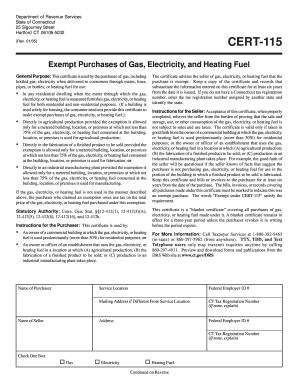

Get Ct Cert-115 2005-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CT CERT-115 online

How to fill out and sign CT CERT-115 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When the tax period started unexpectedly or you merely overlooked it, it could potentially result in issues for you.

CT CERT-115 is not the easiest form, but you have no cause for concern in any situation.

With this comprehensive digital solution and its useful features, completing CT CERT-115 becomes simpler. Don’t hesitate to utilize it and invest more time in your hobbies rather than in preparing documents.

- Access the document in our sophisticated PDF editor.

- Complete the necessary information in CT CERT-115, using fillable fields.

- Add images, ticks, checkboxes, and text fields as required.

- Repeated entries will be populated automatically after the first submission.

- If you encounter difficulties, activate the Wizard Tool. You will receive some guidance for smoother submission.

- Always remember to include the application date.

- Generate your personalized e-signature once and place it in all the necessary locations.

- Review the information you have entered. Amend errors if needed.

- Click Done to complete the changes and choose the method you will use to send it. You can opt for virtual fax, USPS, or email.

- Alternatively, you can download the document to print it later or upload it to cloud storage.

How to revise Get CT CERT-115 2005: personalize forms online

Place the right document editing tools at your disposal.

Complete Get CT CERT-115 2005 with our reliable tool that features editing and eSignature capabilities.

If you aim to finalize and authenticate Get CT CERT-115 2005 online effortlessly, our cloud-based solution is the perfect choice. We provide a rich catalog of template-based forms that you can alter and finish online. Additionally, there's no need to print the form or use external solutions to render it fillable. All necessary functions will be readily available for you as soon as you access the document in the editor.

Let’s explore our online editing tools and their key features. The editor offers an intuitive interface, so it won't take long to learn how to use it.

We’ll examine three primary sections that allow you to:

Our editor simplifies modifying and certifying the Get CT CERT-115 2005. It allows you to manage various aspects related to document handling. Furthermore, we prioritize ensuring that your experience with files is secure and adheres to essential regulatory standards. All these factors enhance the enjoyment of using our tool. Retrieve Get CT CERT-115 2005, perform the necessary edits and adjustments, and download it in your preferred file format. Give it a try today!

- Revise and annotate the template

- Organize your documents

- Make them shareable

- Secure your document with a password

- Add a watermark

- Convert the document to the desired format

Related links form

The Cert 119 form in Connecticut is a tax exemption certificate used primarily for claiming sales and use tax exemption for specific purchases. This form works alongside the CT CERT-115, which provides broader exemptions applicable to most goods and services. It's essential to know how both forms fit into your tax strategy for optimal financial planning.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.