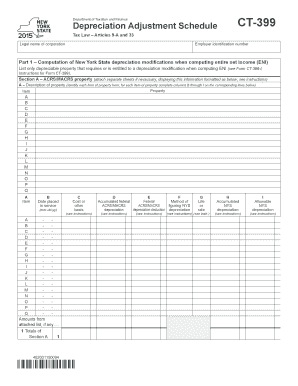

Get Ny Dtf Ct-399 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY DTF CT-399 online

How to fill out and sign NY DTF CT-399 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Currently, the majority of Americans prefer to handle their own tax returns and, in fact, to complete documents in digital format. The US Legal Forms online service streamlines the e-filing process for the NY DTF CT-399, making it quick and convenient. Now it takes no longer than 30 minutes, and you can do it from anywhere.

Suggestions for completing the NY DTF CT-399 swiftly and simply:

Make sure that you have accurately completed and submitted the NY DTF CT-399 by the deadline. Pay attention to any cut-off dates. Providing incorrect information in your financial documents may result in hefty penalties and create issues with your yearly tax return. Utilize only reliable templates from US Legal Forms!

- Open the PDF form in the editor.

- Look for the highlighted fillable fields. This is where your information needs to go.

- Select the option to choose if you see the checkboxes.

- Use the Text tool and other robust features to personally modify the NY DTF CT-399.

- Verify all information before proceeding to sign.

- Create your unique eSignature using a keyboard, camera, touchpad, mouse, or mobile device.

- Authenticate your template online and specify the exact date.

- Click on Done to continue.

- Store or send the file to the intended recipient.

How to modify Get NY DTF CT-399 2015: personalize forms online

Experience a hassle-free and paperless method of working with Get NY DTF CT-399 2015. Utilize our dependable online service and conserve significant time.

Creating every document, including Get NY DTF CT-399 2015, from the ground up takes excessive time, so having a tried-and-true set of pre-prepared form templates can work wonders for your productivity.

However, using them can pose challenges, particularly regarding files in PDF format. Fortunately, our extensive library features an integrated editor that enables you to effortlessly fill out and modify Get NY DTF CT-399 2015 without needing to leave our site, ensuring you don’t squander time altering your documents. Here’s how to handle your document using our tools:

Whether you need to manage editable Get NY DTF CT-399 2015 or any alternate document offered in our collection, you’re heading in the right direction with our online document editor. It's simple and secure and doesn’t necessitate any specific technical knowledge. Our web-based tool is designed to tackle nearly everything you can envision regarding document editing and finalization.

Say goodbye to antiquated methods of handling your documents. Opt for a more effective solution to assist you in optimizing your tasks and making them less dependent on paper.

- Step 1. Find the required form on our website.

- Step 2. Click Get Form to access it in the editor.

- Step 3. Utilize our advanced editing functions that enable you to insert, delete, comment, and highlight or redact text.

- Step 4. Create and add a legally-recognized signature to your document by utilizing the sign feature from the upper toolbar.

- Step 5. If the document layout doesn’t appear as you wish, employ the tools on the right to delete, add more, and rearrange pages.

- Step 6. Include fillable sections so other individuals can be invited to complete the document (if necessary).

- Step 7. Distribute or send the document, print it out, or choose the format in which you wish to download the file.

Get form

In New York City, the mortgage recording tax is calculated based on the amount of the mortgage. As of now, the tax rate varies depending on whether the property is residential or commercial, and it can be quite substantial. The NY DTF CT-399 provides guidance on how to report this tax accurately. Knowing the tax rates can help you budget effectively when securing a mortgage in NYC.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.