Loading

Get Co Dr 1002 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CO DR 1002 online

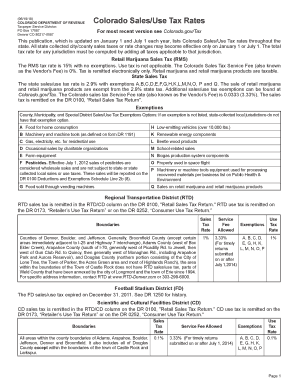

The CO DR 1002 form is essential for reporting sales and use tax details in Colorado. This guide will assist users in completing this form accurately and efficiently, ensuring compliance with state requirements.

Follow the steps to fill out the CO DR 1002 online effectively.

- Press the ‘Get Form’ button to access the CO DR 1002 form and open it in the required editor.

- Begin by entering the reporting period for which you are filing. Clearly indicate the start and end dates.

- In the section designated for sales details, provide accurate figures for total sales, exempt sales, and the taxable sales amount in the corresponding fields.

- Next, enter the calculation for any local sales tax that applies to your jurisdiction. Make sure to aggregate the various local rates as applicable.

- Fill out the use tax section if applicable. This includes items purchased from out of state that are subject to use tax.

- Review and finalize the entries, ensuring all fields are filled accurately with the correct figures.

- Once you have saved all changes, you can choose to download, print, or share the completed CO DR 1002 form as needed.

Complete your CO DR 1002 form online today for a streamlined tax reporting experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To fill out a Texas sales and use tax resale certificate, enter your name, business name, and address at the top of the form. Specify the type of business and provide your Texas sales tax permit number. It's important to detail the products you plan to resale. For further help with the CO DR 1002 aspect of this process, consider accessing resources from US Legal Forms.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.