Get Irs 1040 - Schedule B 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule B online

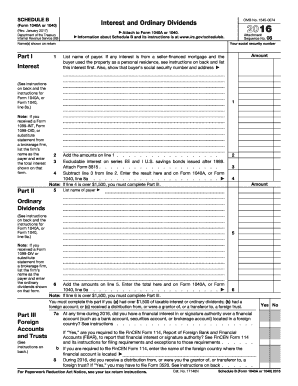

Filling out the IRS 1040 - Schedule B is an important step for reporting your interest and ordinary dividends. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to successfully complete Schedule B online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name and social security number as shown on your return at the top of the form.

- If you received any Form 1099-INT or Form 1099-OID, include the amounts from these forms as instructed.

- Proceed to Part II and report your ordinary dividends on line 5. Likewise, list the payer's name and the amounts received, using Form 1099-DIV if available.

- Move to Part III if your total interest or ordinary dividends exceed $1,500. Answer the questions regarding foreign accounts and trusts accurately.

- After completing all sections, review your entries for accuracy. Then, save your changes, download the form, and print or share it as necessary.

Start filling out your IRS 1040 - Schedule B online today to ensure accurate reporting of your interest and dividends.

Get form

Related links form

Schedule B is a supplemental form that complements the IRS 1040 and is used to report interest and dividend income. It details the sources of this income, which is essential for calculating your overall tax liability. Understanding how to fill out Schedule B correctly can help avoid delays or issues with your tax filing. For straightforward guidance on this process, consider uslegalforms for expert assistance with the IRS 1040 - Schedule B.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.