Loading

Get Ia Form 7 2002-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IA Form 7 online

Filling out the IA Form 7 online can seem daunting, but this guide aims to simplify the process for you. By following these steps, you will be able to complete the form accurately and efficiently.

Follow the steps to fill out the IA Form 7 online effectively

- Press the ‘Get Form’ button to access the IA Form 7 and open it in your preferred digital editor.

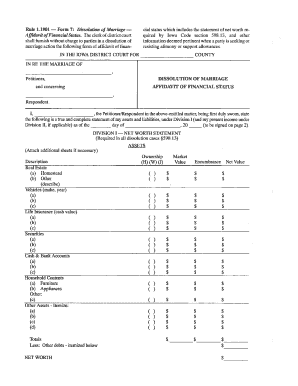

- Read through the introduction section of the form. This section provides essential context about the IA Form 7, its purpose, and any relevant guidelines.

- Complete the personal information section. Enter your full name, address, and contact details accurately. Ensure that this information reflects your current status.

- In the details section, provide specific information as prompted. Follow any examples provided to ensure clarity and accuracy.

- Review all entered information for accuracy. If there are any errors or omissions, correct them before moving on.

- Once you have filled in all sections of the form, you can choose to save your changes, download the completed form, print a hard copy, or share it with relevant parties.

Start filling out your IA Form 7 online today to ensure your application is processed smoothly.

Related links form

Yes, the IRS form 720 can be filed electronically. This convenience allows you to submit your quarterly excise tax return online rather than using paper forms. Filing electronically can save you time and help minimize errors in your submission. Utilizing available e-filing services can simplify the process significantly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.