Loading

Get Ct Lgl-001 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT LGL-001 online

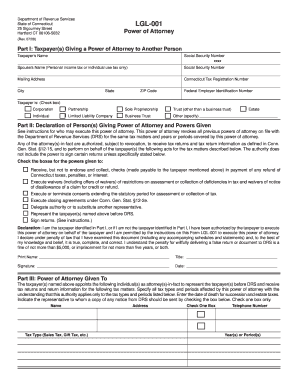

Filling out the CT LGL-001 form, known as the Power of Attorney form, is essential for authorizing an individual to represent you before the Connecticut Department of Revenue Services. This guide will provide clear and concise instructions to help you complete this form effectively.

Follow the steps to fill out the CT LGL-001 form online

- Click ‘Get Form’ button to obtain the form and open it in your preferred online environment for editing.

- In Part I, provide the taxpayer’s name and address along with the Social Security Number or Connecticut Tax Registration Number. If applicable, include your spouse’s name and SSN for joint personal income tax returns.

- Select the type of taxpayer by checking the appropriate box to indicate whether it is a corporation, partnership, sole proprietorship, trust, estate, individual, limited liability company, business trust, or other.

- In Part II, sign the declaration confirming your identity as the taxpayer or your authority to act on behalf of the taxpayer. Check the boxes for the specific powers granted to the attorney-in-fact.

- In Part III, provide the names, addresses, and telephone numbers of the individuals designated as attorney(s)-in-fact. Specify the tax types and periods that the power of attorney covers, ensuring to provide accurate details for the tax matters.

- Review all the information entered into the form for accuracy. Ensure all required fields are completed correctly.

- After confirming all information is correct, users can save changes, download, print, or share the completed form as needed.

Complete your CT LGL-001 form online to ensure proper representation for your tax matters.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To amend a tax return that you already filed, you will need to fill out and submit Form CT-1040X with the necessary corrections. It's crucial to explain the changes you are making clearly. Using an efficient service such as uslegalforms can guide you through the requirements and assist you with CT LGL-001.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.