Loading

Get Med 1 Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Med 1 Form online

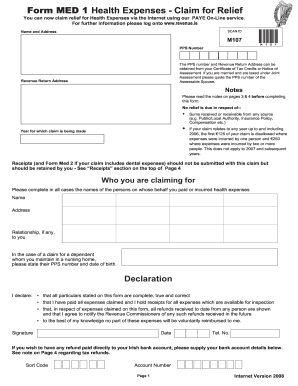

Filling out the Med 1 Form online allows you to claim relief for health expenses efficiently. This guide provides a step-by-step approach to ensure you complete the form accurately and submit it correctly.

Follow the steps to complete the Med 1 Form online.

- Click ‘Get Form’ button to access the Med 1 Form and open it in your chosen editor.

- Fill in your name and address in the designated fields. Ensure the information is accurate as it will be used for correspondence.

- Enter your PPS number, which can be found on your Certificate of Tax Credits or Notice of Assessment. If married, include the PPS number of your assessable partner if you are jointly assessed.

- Indicate the year for which you are claiming relief. It is important to specify the correct tax year as this impacts your claim.

- Provide details of individuals for whom the health expenses were incurred, including their names, addresses, and relationship to you, if any.

- Complete the declaration section, confirming the truthfulness of the information provided and your compliance with the claims process.

- Fill in your bank account details if you wish any refund to be paid directly to your Irish bank account.

- Enter income details for yourself and your spouse, if applicable, including employer names, total pay, and total tax deducted for the year of claim.

- List your routine health expenses and non-routine dental treatment costs, ensuring you do not forget to claim for items that qualify under the provided categories.

- Deduct any sums received or receivable regarding your health expenses. Make sure to provide the necessary details of these amounts.

- Calculate the total health expenses and the amount on which tax relief is claimed by summing valid expenses and accounting for deductions.

- Once you have completed the form and verified all the information, save changes, download it, or print it for submission.

Complete your Med 1 Form online today to streamline your health expense claims.

As a self-employed individual in Ireland, you can claim expenses such as business-related travel, office supplies, and utilities. It is essential to keep thorough records of these expenses. Utilizing the Med 1 Form can help you categorize and claim applicable medical expenses related to your self-employment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.