Loading

Get Payoff Authorization Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Payoff Authorization Form online

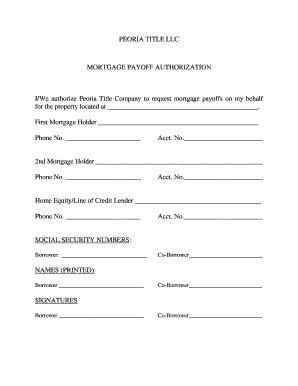

Completing the Payoff Authorization Form online is a straightforward process that allows you to authorize Peoria Title Company to request mortgage payoffs on your behalf. Follow the steps below to ensure that all necessary information is accurately provided.

Follow the steps to successfully complete the Payoff Authorization Form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, you will need to input the address of the property for which you are requesting mortgage payoffs. Ensure that this information is accurate and complete.

- Next, fill in the details for the first mortgage holder. This includes the name of the lender, their phone number, and the account number associated with the mortgage. Double-check these entries for correctness.

- Proceed to the section for the second mortgage holder. Similar to the previous step, provide the lender's name, their phone number, and the account number relevant to this mortgage.

- In the home equity or line of credit lender section, enter the required details: lender name, phone number, and account number. Accuracy is crucial here as well.

- Next, you need to enter the social security numbers of both the borrower and the co-borrower. This information should be handled with care to ensure privacy and security.

- Print or type your names in the designated section for both the borrower and co-borrower. Make sure to use clear and legible characters.

- Finally, both the borrower and co-borrower must sign the document to validate the authorization. After completing all sections, you can save changes, download, print, or share the form as needed.

Complete your Payoff Authorization Form online seamlessly and with confidence.

In order to sell a vehicle you owe money on, you need to request a loan payoff amount from your current lender. ... Listed in the loan payoff quote is the accruing additional interest, amount owed from the last statement, and any fees or early payoff penalties, if applicable. Getting the payoff quote is simple.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.