Get Indemnification Undertaking By Student Format 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Indemnification Undertaking By Student Format online

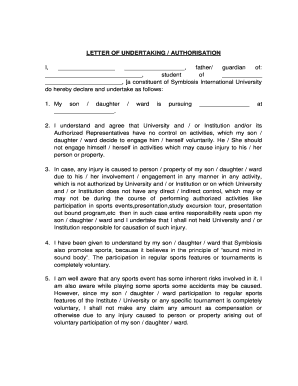

Completing the Indemnification Undertaking By Student Format is an important step in ensuring that students are aware of their responsibilities and the associated risks involved with their activities at the university. This guide will provide clear and concise instructions for filling out the form online, making the process straightforward and accessible for all users.

Follow the steps to complete the Indemnification Undertaking By Student Format online.

- Click the ‘Get Form’ button to obtain the form and open it for editing.

- Begin by filling out your name in the designated field, including your first and last name, as well as your relationship to the student (e.g., parent or guardian). Ensure that these details accurately represent your position.

- Next, enter the full name of the student who is the subject of this undertaking. This is the individual for whom you are providing consent.

- Indicate the course or program that the student is pursuing. Be sure to provide the full name of the course to avoid any discrepancies.

- Acknowledge and agree to the terms regarding voluntary participation in activities. This section emphasizes your understanding that the university does not control all activities that the student may engage in.

- Review the risks associated with sports and other activities, confirming that you understand and accept that participation is voluntary, and therefore, you will not hold the university responsible for any injuries.

- Authorize the university or institution to give consent on your behalf for medical procedures in case of emergencies. This step is critical, especially in situations where immediate medical decisions are necessary.

- Include your acknowledgment of the insurance coverage details provided by the university. Confirm your understanding of the financial responsibilities outlined in the document.

- Finally, review all the information entered in the form for accuracy. Once satisfied, sign the document electronically if possible, or prepare to print and sign it manually, along with the date and the place of signing.

- After signing, save your changes, and if necessary, download, print, or share the completed document as required.

Complete the Indemnification Undertaking By Student Format online today to ensure smooth processing and compliance.

Writing an indemnity clause involves defining roles, risks, and responsibilities in clear terms. Begin with stating who is indemnifying whom and under what circumstances. Utilizing a practical format like the Indemnification Undertaking By Student Format can guide you through drafting an effective clause that protects all parties involved.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.