Loading

Get Bir Form 1606

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bir Form 1606 online

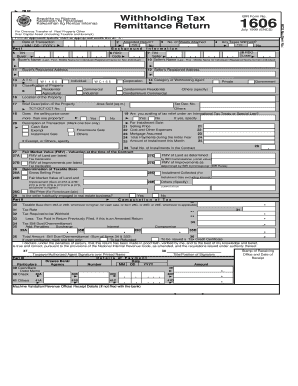

Filling out the Bir Form 1606, which is the Withholding Tax Remittance Return for the transfer of real property, can be straightforward when following the correct steps. This guide provides clear instructions to help you navigate the online process efficiently.

Follow the steps to complete the Bir Form 1606 online.

- Press the ‘Get Form’ button to acquire the Bir Form 1606 and open it in your browser.

- Fill in the date of transaction in the specified format (MM/DD/YYYY). Ensure that the number of sheets attached is indicated accurately.

- State whether any taxes were withheld during the transaction by marking the appropriate box.

- If applicable, indicate if this is an amended return by checking the corresponding box.

- In Part I, provide background information including your Taxpayer Identification Number (TIN) and the Regional District Office (RDO) codes for both the buyer and seller.

- Enter the names and registered addresses of both the buyer and seller, ensuring that you follow the specified naming conventions.

- Classify the type of property being transferred (residential, commercial, etc.), and describe the property briefly.

- Determine if the selling price covers more than one property, and indicate the Tax Declaration Number associated with the transaction.

- Select the appropriate method of transaction (e.g., cash sale, installment sale) and provide any additional details required.

- Gather and calculate the fair market values based on the guidelines provided in the form.

- Complete the computation of the taxable base, applying the relevant tax rate as outlined in Part II.

- Subtract any previously paid tax for amended returns and add any necessary penalties or surcharges.

- Review all inputted data for accuracy before moving on to finalize the form.

- Once everything is complete, you can save your changes, download the form, print it for your records, or share it as necessary.

Take the next step and fill out your Bir Form 1606 online to ensure compliance with tax requirements.

The certificate of creditable tax withheld at source is typically issued through BIR Form 2316 or BIR Form 2307. These forms confirm the taxes already withheld from your income, which you can claim during the tax return process. If you're dealing with income taxes, using BIR Form 1606 helps you understand how these withholdings fit into your overall tax obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.