Loading

Get Aa4_8 - English Version

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AA4_8 - English Version online

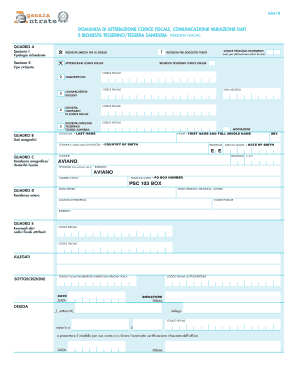

Filling out the AA4_8 - English Version online can streamline the process of obtaining a tax identification number and updating personal information. This guide provides clear instructions to help you navigate each section effectively.

Follow the steps to successfully complete the AA4_8 form online.

- Click the ‘Get Form’ button to access the AA4_8 - English Version and open it for editing.

- Begin with Section I, where you need to indicate whether you are completing the form for yourself or as a representative for someone else. Select 'Request for yourself' or 'Request for a third party' accordingly.

- In Section II, you will select the type of request you are making. Options include 'Attribution of tax code,' 'Change of details,' 'Notification of death,' 'Request for tax code certificate,' or 'Request for duplicate health card.' Choose the appropriate option that fits your circumstance.

- Provide your personal details in the designated fields, such as your last name, first name, date of birth, and country of birth. Ensure that all information is accurate and corresponds with official documents.

- Continue to fill out your residential information in the designated section. This includes your address, postal code, and the municipality or province of residence.

- If applicable, provide details of any foreign residence in Section D. Fill in the address and postal code for your location abroad.

- Complete any additional fields for other tax codes if you have previously been assigned any. This information may be important for processing your request accurately.

- Once all sections are filled, review your entries for accuracy. After confirming that the information is correct, proceed to the signature section to sign and date the form.

- Final steps include saving your changes, downloading a copy of the completed form, and print it if you need a paper copy. You may also have the option to share or submit the form online, depending on the system's capabilities.

Complete your AA4_8 - English Version online today for efficient processing!

Yes, a US citizen can obtain a Codice Fiscale in Italy. The process involves filling out an application at the local tax office or using online services like uslegalforms. This code is essential for various transactions, including banking and real estate dealings.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.