Loading

Get Tax Client Intake Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TAX CLIENT INTAKE FORM online

Filling out the Tax Client Intake Form online is a crucial step for ensuring accurate tax preparation. This guide provides a clear and structured approach to help you provide all necessary information effectively.

Follow the steps to complete your form with ease.

- Press the ‘Get Form’ button to obtain the Tax Client Intake Form and open it in your preferred online editor.

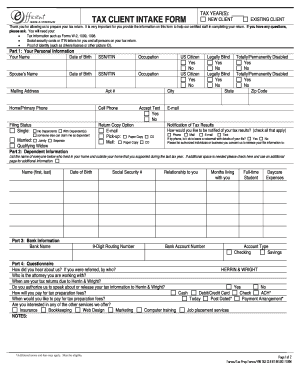

- In Part 1, provide your personal information. This includes your name, date of birth, social security number or ITIN, and occupation. If applicable, include your spouse’s information as well.

- Complete the mailing address section, ensuring your street address, apartment number (if any), city, state, and zip code are correct. Include both your home and cell phone numbers.

- Select your filing status: single, married jointly, married separately, or qualifying widow. Indicate your preferred return copy option: email, pick-up, paper copy by mail, or a combination.

- In Part 2, provide details about any dependents. Indicate whether they are US citizens and if they are legally blind or totally/permanently disabled.

- Input your bank information in Part 3, including your bank name, account type, account number, and routing number. Specify your relationship to the account and how long the individual has lived with you.

- Part 4 includes a questionnaire regarding referrals and payment options for tax preparation fees. Answer all questions accurately and select your payment method.

- Review the Terms & Conditions in Part 5. Initial each section to acknowledge your agreement, and sign the document electronically.

- Finally, save your completed form. You can download it, print it, or share it as needed.

Complete your TAX CLIENT INTAKE FORM online for efficient tax preparation.

structured TAX CLIENT INTAKE FORM should include personal information, income data, tax deductions, and credits. It should also prompt clients for supporting documents and outline any specific tax concerns. Including these elements allows tax professionals to analyze each client’s circumstances thoroughly. Therefore, a comprehensive form contributes to an efficient and effective tax preparation process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.