Get Form 843 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 843 online

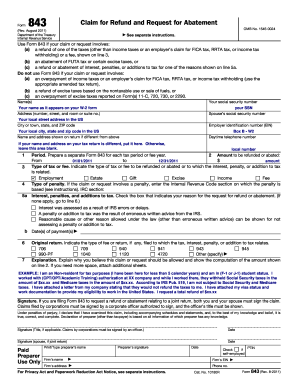

This guide provides a comprehensive overview on how to fill out Form 843, which is used for requesting a refund or abatement of certain taxes and fees. Whether you are familiar with tax forms or not, this guide aims to assist you in completing the form effectively online.

Follow the steps to successfully complete your Form 843.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin filling out the top section of the form. Provide your name as it appears on your W-2, your social security number, and your address, including city, state, and ZIP code. If applicable, include your spouse’s social security number.

- In the next section, specify the tax period or fee year for which you are requesting a refund or abatement. Ensure to use a separate Form 843 for each tax period.

- Indicate the amount you wish to be refunded or abated by entering the appropriate figures on the designated lines.

- Select the type of tax or fee that your request pertains to by checking the relevant box. Types include employment, excise, and others.

- If applicable, provide details on the penalties you are requesting to be abated. Enter the relevant Internal Revenue Code section.

- In the explanation section, provide a clear rationale for your request. Detail any relevant computations and attach additional sheets if necessary.

- Finally, ensure that all required signatures are provided. If filing jointly, both partners must sign. Include the date and any preparer information if applicable.

- Once the form is completed, proceed to save any changes, then download, print, or share the completed Form 843 as necessary.

Complete your Form 843 online today to ensure a smooth submission process.

The best explanation for Form 843 is that it is a request to the IRS for penalty relief. Through this form, you can present your case for why you should not incur penalties or interest due to circumstances that impacted your ability to comply with tax regulations. Understanding the details of your situation and conveying them effectively on Form 843 can significantly enhance your chances of a favorable outcome.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.