Loading

Get Form Bwc 7578 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Bwc 7578 online

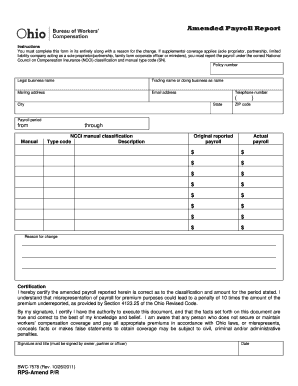

Filling out the Form Bwc 7578 online is a straightforward process that allows users to amend payroll reports efficiently. This guide provides detailed instructions on how to navigate each section of the form.

Follow the steps to complete your amended payroll report.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your policy number in the designated field. This unique identifier links the form to your insurance policy.

- Provide the legal business name as registered with the authorities. Ensure that this name exactly matches your official documentation.

- Fill in the trading name or doing business as name, if applicable. This is the name under which your business operates.

- Input your mailing address, ensuring to include the city, state, and ZIP code. This address will be used for correspondence regarding your report.

- Record your email address and telephone number for any necessary follow-up regarding your report.

- Specify the payroll period by entering the start and end dates in the format required, indicating from which date to which date the payroll is being reported.

- Select the appropriate NCCI manual classification and type code related to your business operations. This ensures proper categorization for payroll coverage.

- Enter the original reported payroll and the actual payroll in their respective fields, ensuring all figures are accurate and reflect your records.

- Provide a reason for the change in payroll reporting. This section is important to clarify why the amendments were necessary.

- Read the certification statement carefully. By signing, you affirm that the information provided is accurate and that you have authority over the document.

- Have the form signed by the owner, partner, or officer. This signature must be completed to validate the report.

- Finally, save your changes. You may also download, print, or share the completed form as needed.

Complete your Form Bwc 7578 online today to ensure accurate payroll reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filing an Ohio BWC true up report involves reconciling your estimated and actual payroll figures for the year. Start by gathering your payroll records and completing the necessary forms, including the Form Bwc 7578, for accurate reporting. It’s important to file your true up on time to avoid penalties. For assistance, platforms like uslegalforms can guide you through the reporting process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.