Loading

Get Fl Taxpayer Identification Number (tin) And Certification (substitute For Irs Form W-9) - County Of 2009-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL Taxpayer Identification Number (TIN) and Certification (Substitute For IRS Form W-9) - County Of online

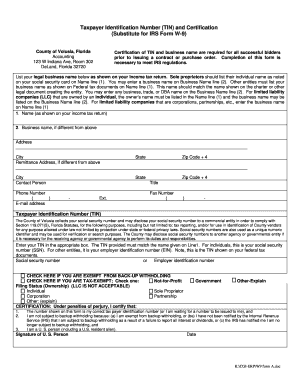

This guide provides clear instructions on how to complete the FL Taxpayer Identification Number (TIN) and Certification form online. By following these steps, users can ensure accurate submission to meet IRS regulations and facilitate successful bidding.

Follow the steps to fill out the FL TIN and Certification form online:

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter your legal business name in Line 1 as it appears on your income tax return. For sole proprietors, list your individual name as stated on your social security card.

- If applicable, provide your business name on Line 2; this can be any DBA name or trade name related to your legal business name.

- Fill in your address, including street, city, state, and zip code in the designated fields.

- If you have a remittance address that differs from your primary address, please fill it in the provided section.

- Provide contact information, including the contact person's name, phone number, email address, and title.

- Enter your Taxpayer Identification Number (TIN) in the appropriate box. This will be your social security number (SSN) for individuals or employer identification number (EIN) for business entities.

- Check the appropriate boxes to indicate if you are exempt from backup withholding or if you are tax-exempt, and specify your filing status.

- In the certification section, complete the declarations under penalties of perjury, affirming that your TIN is correct and that you meet any backup withholding criteria.

- Lastly, provide your signature and date where indicated to certify the information on the form is accurate.

- Once all fields are completed, you may save changes, download, print, or share the completed form as needed.

Complete your FL Taxpayer Identification Number (TIN) and Certification form online today!

A US Taxpayer Identification Number (TIN) typically consists of nine digits. This number can be formatted in various ways, such as 123-45-6789. When obtaining a FL Taxpayer Identification Number (TIN) And Certification (Substitute For IRS Form W-9) - County Of, it is essential to follow this format to ensure compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.