Get Fha Financing Addendum Maryland 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FHA Financing Addendum Maryland online

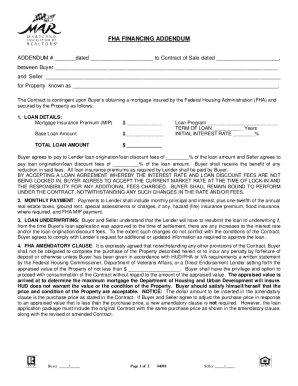

The FHA Financing Addendum Maryland is an essential document that outlines specific terms and conditions for a real estate transaction involving Federal Housing Administration financing. This guide provides clear instructions for completing the addendum online, ensuring that you understand each section and component involved in the process.

Follow the steps to effectively fill out the FHA Financing Addendum Maryland online.

- Click the ‘Get Form’ button to obtain the FHA Financing Addendum Maryland and open it in your editor of choice.

- Begin by entering the date of the addendum and the date of the contract of sale at the top of the form.

- Fill in the names of the Buyer and Seller in the respective fields.

- Provide details about the property including the property address in the designated area.

- In the Loan Details section, input the Mortgage Insurance Premium (MIP), Base Loan Amount, Total Loan Amount, Loan Program, Term of Loan in years, and Initial Interest Rate percentage.

- Specify the loan origination or loan discount fees for both the Buyer and Seller, ensuring clarity on who pays what percentage.

- Complete the Monthly Payment section by including the necessary details like principal, interest, and additional required payments mentioned.

- Understand the Loan Underwriting requirements by reviewing and confirming your willingness to provide additional information if required.

- In the FHA Amendatory Clause, enter the appraised value as per HUD requirements, ensuring it aligns with the property purchase price.

- Document the Mortgage Insurance conditions including how and when these will be paid.

- Fill in the Termite Inspection section details regarding the inclusivity of inspections for the property.

- Complete the Lender Required Repairs section by entering any necessary financial caps or conditions related to required repairs.

- Provide certification by having all parties involved (Buyer, Seller, and Broker) sign and date the addendum.

- Finally, save the changes to your form after completing all sections. You can choose to download, print, or share the completed document as needed.

Start filling out the FHA Financing Addendum Maryland online to ensure a smooth and compliant real estate transaction.

An FHA disclosure is a statement provided to homebuyers that outlines important information regarding the FHA financing terms. This disclosure helps buyers understand the specific costs, risks, and benefits associated with FHA loans. In Maryland, the FHA Financing Addendum ensures that all required disclosures are included in the contract, promoting transparency and informed decision-making throughout the transaction.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.