Loading

Get Form Aos1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form AOS1 online

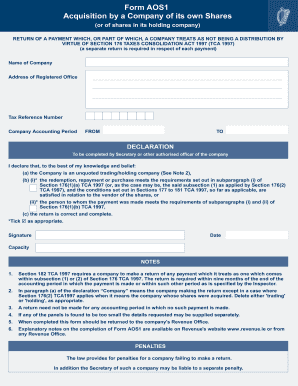

Filling out the Form AOS1 online can be straightforward with the right guidance. This guide provides step-by-step instructions to help you complete the form accurately and efficiently, ensuring compliance with the relevant tax regulations.

Follow the steps to complete the Form AOS1 online:

- Press the ‘Get Form’ button to access the Form AOS1 and open it for editing.

- In the section labeled 'Name of Company', enter the full legal name of the company submitting the form.

- Provide the 'Address of Registered Office' for the company, ensuring it is accurate and up to date.

- Input the 'Tax Reference Number' associated with the company, which is essential for tax identification.

- Fill in the 'Company Accounting Period' by specifying the period under which the payment falls.

- Complete the 'FROM' and 'TO' fields to indicate the date range of the accounting period.

- In the declaration section, ensure a Secretary or authorized officer completes the declaration accurately, ticking the appropriate boxes as needed.

- Sign and date the form in the 'Signature' and 'Date' fields, along with the 'Capacity' in which the person is acting.

- Provide further details requested in Sections A through G as relevant, ensuring all shares, payments, and vendor information are included.

- After all fields are completed, review your entries for accuracy before saving changes, downloading, printing, or sharing the form as needed.

Complete your Form AOS1 online to ensure timely and accurate submission.

Filing Form 8832 online requires you to electronically submit the form to the IRS through their e-filing system. Ensure you have your entity's information, such as the name, EIN, and address handy. Platforms like US Legal Forms can offer valuable insights and templates to aid you in completing the filing efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.