Get Irs Form W 4v Printable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form W-4V Printable online

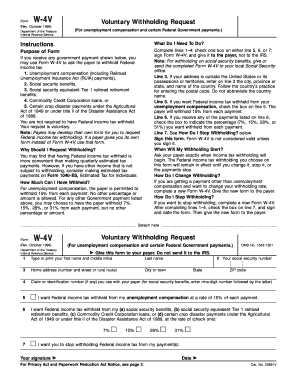

The IRS Form W-4V is a Voluntary Withholding Request used to request withholding of federal income tax from certain government payments. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the IRS Form W-4V online.

- Click 'Get Form' button to obtain the form and open it in your editor.

- Complete lines 1 through 4 of the form. Enter your first name, middle initial, and last name in the designated fields. Then provide your home address, city or town, state, and ZIP code. If applicable, include your claim or identification number.

- On line 5, if you would like federal income tax withheld from your unemployment compensation, check the box provided. This will result in 15% being withheld from each payment.

- On line 6, indicate if you receive any of the specified payments. If so, check the appropriate box and select the desired percentage (7%, 15%, 28%, or 31%) to be withheld from each payment.

- On line 7, if you want to stop withholding completely, check the corresponding box.

- Sign and date the form. Remember, the form is not valid unless signed.

- After completing the form, save your changes. You can download, print, or share the form as needed. Finally, submit it to your payer, not the IRS.

Take action today and fill out the IRS Form W-4V online to manage your federal income tax withholding.

The number of exemptions you should claim in your VA 4 depends on your personal financial situation, including dependents and other factors. Claiming the right number of exemptions ensures that you do not withhold too much or too little from your paycheck. Many people choose to consult guidelines provided with the IRS Form W 4v Printable to reach an informed decision. Accurate claims lead to better financial planning.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.