Loading

Get Closing Disclosure 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Closing Disclosure online

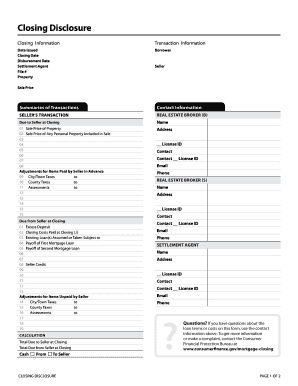

Completing the Closing Disclosure is a crucial step in your real estate transaction. This guide provides a clear, step-by-step approach to filling out the form online, ensuring that you understand each component and its relevance to your closing process.

Follow the steps to complete your Closing Disclosure with ease.

- Click ‘Get Form’ button to obtain the form and open it in the appropriate editor.

- Fill in the closing information section, which includes details such as the date issued, closing date, and disbursement date. Be sure to accurately enter the settlement agent's information and file number associated with your transaction.

- Provide the property details, including the sale price. This section outlines the financial aspects of the property being sold.

- Complete the borrower and seller sections. Ensure you enter the names of all parties involved accurately.

- In the summaries of transactions section, fill in the seller's transaction details, which may include commission amounts for real estate brokers, as well as other financial adjustments or credits.

- Proceed to the closing cost details. In the loan costs section, input specific charges, both at closing and before closing, ensuring you differentiate between seller-paid and borrower-paid costs.

- Record any other costs, such as taxes, insurance, and escrow payments. Ensure you include all relevant fees to reflect an accurate total closing cost.

- Review all sections for accuracy. Make any necessary corrections to ensure the integrity of the information provided.

- Once complete, you can save changes to the document. You may choose to download or print the Closing Disclosure for your records, or share it with relevant parties involved in the transaction.

Start filling out your Closing Disclosure online today to ensure a smooth closing process.

Related links form

Your house closing statement can usually be found through your lender or title company. They store these records and can provide you with a copy upon request. Additionally, you should find it filed in your local county records office after closing. Utilizing services from USLegalForms can also help you track down important documents related to your closing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.