Get Self Employment Ledger 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Self Employment Ledger online

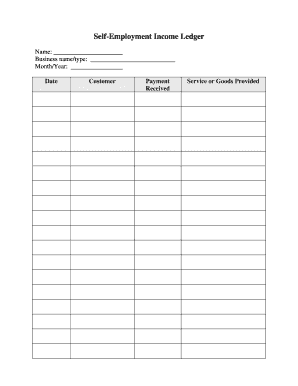

Filling out the Self Employment Ledger online is an essential step for individuals managing their self-employment income. This guide will provide you with clear and concise instructions to ensure that you can complete the form accurately and efficiently.

Follow the steps to fill out the Self Employment Ledger online.

- Click ‘Get Form’ button to obtain the Self Employment Ledger form and open it in your preferred online editor.

- Enter your full name in the designated 'Name' field. Make sure that your name is accurate, as it will be used for identification purposes.

- Fill in the 'Business name/type' field with the name of your business or the type of self-employment you are engaged in. This information provides clarity regarding your business activities.

- In the 'Month/Year' section, specify the month and year for which you are recording your self-employment income. This ensures your records are organized chronologically.

- For the 'Date' field, provide the specific date on which you received payments or provided services during that month. This helps track your income accurately.

- In the 'Customer' field, list the name or identifying information of the customer to whom you provided services or goods. This is important for billing and record-keeping.

- Next, log the 'Payment Received' information. Enter the amount you were paid for the services or goods provided. Ensure that the figures are accurate to reflect your earnings.

- In the 'Service or Goods Provided' section, detail the specific service or product you provided to the customer. This clear description is vital for both record-keeping and tax purposes.

- After filling out all the required fields, review your entries to ensure accuracy. Once satisfied, save your changes. You may choose to download, print, or share the form as needed.

Complete your documents online today to maintain thorough records of your self-employment income.

In Canada, self-employed individuals typically prove their income by using their Self Employment Ledger along with tax documents like T1 returns. Additional documentation may involve bank statements and invoices to confirm earnings. Keeping these records organized simplifies income verification for loans or other financial needs.

Fill Self Employment Ledger

Any accurate, detailed record of your self-employment income and expenses. There isn't a standard self-employment ledger format. It just needs to provide an accurate, detailed record of your self-employment income and expenses. Receipt of this ledger verifies the self- employment income used to determine your eligibility. The attached ledger is used to report the self-employment income you receive each month. Employment ledger form is an accurate, detailed record or document of your selfemployment income and expenses. A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. This Self Employment Ledger Book provides the perfect solution to calculate, track, and document your way through every transaction. Its a self employment verification ledger. The attached ledger is used to report the self-employment income you receive each month.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.