Loading

Get Mn St101 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mn St101 online

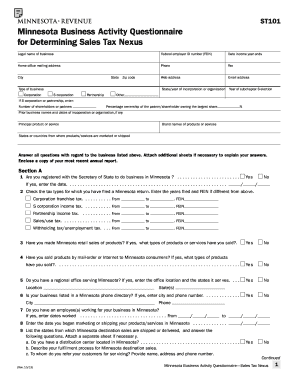

This guide will assist you in completing the Minnesota business activity questionnaire for determining sales tax nexus, commonly referred to as the Mn St101 form. Follow the instructions meticulously to ensure accurate submission.

Follow the steps to fill out the Mn St101 effectively.

- Press the ‘Get Form’ button to obtain the form and open it in your online editor.

- Enter the legal name of your business as registered, along with your federal employer ID number (FEIN). Specify the date your income year ends.

- Select the type of business from the options provided: Corporation, S corporation, Partnership, or Other. If applicable, provide the number of shareholders or partners and the percentage ownership of the partner or shareholder owning the largest share.

- List any prior business names and dates of incorporation or organization, if applicable. Describe your principal product or service and the brand names of products or services.

- Specify the states or countries from which your products/services are marketed or shipped. Answer all questions regarding the business listed above.

- In Section A, answer questions about your registration with the Secretary of State to do business in Minnesota, including the date if applicable. Check the tax types for which you have filed Minnesota returns and provide relevant years and FEIN if different.

- Complete the remaining sections (B to E) regarding various business activities in Minnesota and affiliated companies, ensuring all questions are answered accurately.

- Review the completed form for accuracy. Once satisfied, save your changes, and download, print, or share the form as needed.

Begin filling out the Mn St101 online to ensure your business complies with Minnesota's sales tax nexus requirements.

The mechanism of action for ST101 involves serving as a crucial tool for sales tax reporting in Minnesota. Businesses use the form to report their taxable sales accurately, thus ensuring that they comply with local tax laws. Filling out the Mn ST101 form correctly aids in calculating the proper amount of tax owed. This systematic approach helps streamline the tax payment process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.