Loading

Get Cpf Form 90 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cpf Form 90 online

Filling out the Cpf Form 90 online is a straightforward process that allows you to submit a refund request for contributions paid in error. This guide provides clear, step-by-step instructions to help you complete the form with confidence.

Follow the steps to complete the Cpf Form 90 online.

- Click the ‘Get Form’ button to obtain the form and open it for editing.

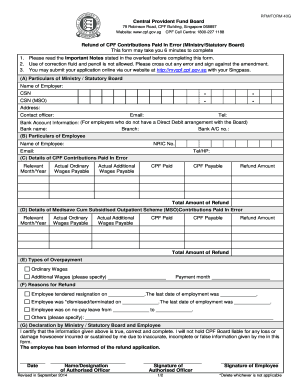

- Enter the particulars of the ministry or statutory board. Provide details such as the name of the employer, address, contact officer, email, and telephone number.

- Fill in the particulars of the employee. This includes the employee's name, NRIC number, email, and telephone number.

- Provide details of the CPF contributions paid in error. Include the relevant month and year, actual ordinary and additional wages payable, the CPF paid, CPF payable, and the refund amount.

- Complete the section on details of Medisave Cum Subsidised Outpatient Scheme contributions paid in error by entering the relevant details as you did in the previous step.

- Specify the types of overpayment, including ordinary wages and additional wages, along with the payment month.

- State the reasons for the refund, selecting from reasons such as resignation, dismissal, termination, or leave of absence. Provide the relevant dates and additional explanations if necessary.

- Complete the declaration by the ministry or statutory board and the employee. Sign and date the form to certify that the information provided is accurate and complete.

- Once all sections are completed, you can save the changes made to the form. You may also download, print, or share the completed document as needed.

Start completing your documents online today for a hassle-free experience.

CPF and SSN serve different purposes and they are not the same. The CPF number is a Brazilian identification number for individuals, used mainly for tax purposes, while an SSN is an American identification number for citizens and some residents in the U.S. It is important to understand these distinctions when handling personal and tax affairs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.