Loading

Get How To Fill Up Treasury Challan Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the How To Fill Up Treasury Challan Form online

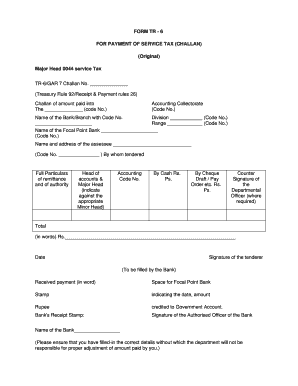

Filling out the Treasury Challan Form online is a straightforward process that ensures your service tax payments are correctly processed. This guide provides you with a clear, step-by-step approach to complete each section of the form confidently.

Follow the steps to complete the Treasury Challan Form online.

- Click ‘Get Form’ button to obtain the Treasury Challan Form and open it in your preferred editor.

- Locate the Challan Number section and enter the appropriate Challan No. This is often a unique identifier related to your transaction.

- Fill in the Major Head by selecting '0044 Service Tax', as this specifies the type of payment being made.

- In the Accounting Collectorate section, input the corresponding code number that identifies your specific area or department.

- Provide the name of the Bank and the corresponding branch code number where the payment will be processed.

- Enter the Division and its code number relevant to the service tax.

- Fill in the Range and its code, which helps to categorize your payment further.

- Identify the Focal Point Bank by entering its name and code number for proper crediting of the payment.

- Complete the name and address of the assessee in the designated area, including their code number.

- Indicate the full particulars of remittance and the authority under which the payment is made.

- Specify the Head of Accounts and Major Head, marking it against the appropriate Minor Head.

- Input the corresponding Accounting Code Number that applies to your payment.

- Detail the amount being paid by cash and the amount being paid by cheque, draft, or pay order, including the total sum.

- If required, provide the counter signature of the departmental officer in the space provided.

- Write out the total amount in words to confirm the numeric entry.

- Include the date of payment at the specified section of the form.

- Sign the form to validate your submission as the tenderer.

- After filling out the form, save your changes, and proceed to download, print, or share the completed form as needed.

Complete your tax payments accurately by filling out the Treasury Challan Form online today.

Filling up a deposit challan requires entering details such as the amount being deposited, the account number, and the branch name. It’s essential to review the information carefully before submission. To streamline your experience while learning How To Fill Up Treasury Challan Form, tools and templates from uslegalforms can be quite helpful.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.