Loading

Get Bir Form 1600 Download

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bir Form 1600 Download online

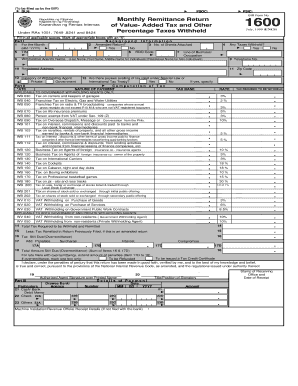

Filling out the Bir Form 1600 Download is essential for proper tax compliance related to value-added tax and other percentage taxes withheld. This guide provides clear instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the Bir Form 1600 Download online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part I, fill in basic background information, including your Taxpayer Identification Number (TIN) and Revenue District Office (RDO) Code. Ensure that you select whether this is an amended return by marking the appropriate box.

- Complete the 'Withholding Agent's Name' section, using the full legal name of the individual or registered name of the non-individual. Provide a telephone number and registered address to ensure correct communication.

- Indicate the number of sheets attached and ensure all applicable spaces are filled out in Part I. Check the 'Any Taxes Withheld?' question and respond accordingly.

- Proceed to Part II, where you will compute the tax by entering the nature of payments and relevant tax rates applicable to your business activities.

- Add up the 'Tax Required to Be Withheld' for each applicable line item and enter this value in the appropriate field to determine total tax obligations.

- If applicable, deduct any taxes remitted in previous returns and calculate the final amount still due or any overremittance which should be enclosed in parentheses.

- In the final part of the form, provide payment details such as the drawee bank and payment particulars. Ensure that all information is accurate and corresponds to the tax remittance.

- Once satisfied with the information entered, save your changes, download, print, or share the completed form as necessary.

Complete your documents online to ensure timely and accurate tax compliance.

Reprinting your tax forms is a straightforward process. If you have previously downloaded your forms, simply locate the saved documents on your device. If not, you can download the necessary forms again, including the Bir Form 1600 Download, from the BIR website to ensure you have the correct, official documents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.