Loading

Get Dr 1c 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dr 1c online

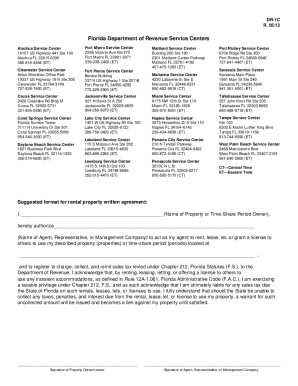

Filling out the Dr 1c application is an essential step for agents wishing to register multiple short-term rental properties. This guide provides a clear, step-by-step approach to assist users in completing the form accurately and efficiently.

Follow the steps to complete the Dr 1c application online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the name of the agent, representative, or management company at the top of the form. Ensure that you provide the correct sales and use tax registration number for the county where the properties are located.

- Fill in your mailing address, including city, state, and ZIP code. Do not forget to include a contact person's name and telephone number for communication purposes.

- Indicate the number of individual properties you are including in this application that are not already registered and calculate the registration fee amount required at $5.00 per property. Make sure to enclose the correct fee along with your application.

- For each property, complete the individual property location information section. This includes checking if the property is a time-share unit, providing the name of the property owner, and entering their SSN, FEIN, or ITIN as applicable.

- Fill in the beginning date of the management agreement and select the type of ownership. Options include Sole Proprietor, Partnership, Corporation, Limited Liability Company, Business Trust, or Non-Business Trust.

- Complete the street address of the property along with the owner's mailing address, ensuring that all fields are filled accurately including city, county, state, and ZIP code.

- If the owner possesses a sales and use tax certificate number, enter it in the designated area. Lastly, provide the owner's telephone number for verification.

- Once all sections are complete, review the application for accuracy. Save your changes, then download, print, or share the form as needed.

Complete your Dr 1c application online today to streamline your short-term rental registration process.

In Florida, there is no state-level gift tax, but it's essential to complete the federal IRS Form 709 for any gifts exceeding the annual exclusion limit. This form ensures that you report gifts accurately for federal tax purposes. Understanding this process is important for estate planning, and consulting the DR 1c may help clarify any related state tax matters.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.