Loading

Get Form 709 Mvat

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 709 Mvat online

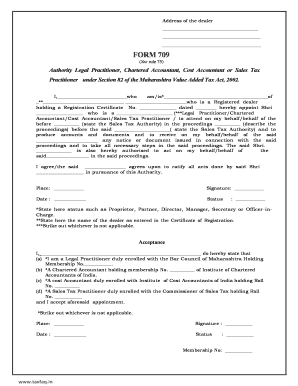

Filling out the Form 709 Mvat online can seem daunting, but with the right guidance, it can be a straightforward process. This guide aims to provide you with clear instructions and support as you complete each section of the form.

Follow the steps to successfully complete the Form 709 Mvat online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name in the appropriate field, indicating who is completing the form. This should be the person representing the registered dealer.

- In the next field, provide the details of the registered dealer as specified in their Registration Certificate, making sure to include the Registration Certificate number and date.

- Designate the individual who will represent the dealer. Input their name and select their role from the options provided, such as legal practitioner or chartered accountant.

- State the Sales Tax Authority before whom the proceedings will take place, along with a brief description of the nature of the proceedings.

- Include your agreement to ratify all actions taken by the appointed representative by initialing the relevant section.

- Fill in the place and date of signing to finalize the document.

- Move to the acceptance section where the appointed representative must indicate their qualifications and membership number by selecting the appropriate options.

- Ensure all necessary fields are completed accurately before proceeding to save your changes, then choose to download, print, or share the form as needed.

Complete your Form 709 Mvat online today to ensure compliance and streamline your processes.

If you gift someone more than $15,000 in one year, you must file Form 709 to report the excess amount. This process allows you to track your lifetime gift tax exemption, preventing any unwanted tax consequences. By leveraging uslegalforms, you can navigate this filing with ease and ensure compliance with IRS regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.