Get Authorization Letter To Process Bir Documents 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Authorization Letter To Process Bir Documents online

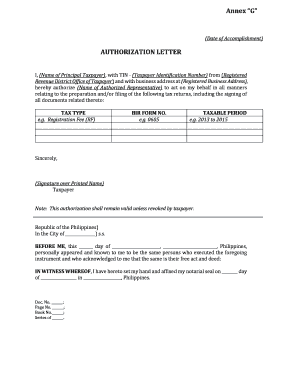

Filling out the Authorization Letter To Process Bir Documents can seem daunting, but with clear guidance, you can complete it accurately and efficiently. This document allows you to authorize a representative to handle your tax affairs, ensuring your compliance with tax regulations.

Follow the steps to fill out the Authorization Letter effectively.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering the 'Date of Accomplishment' at the top of the form. This is the date you are completing the letter.

- In the section for the 'Principal Taxpayer', fill in your full name. Ensure this matches the name associated with your Taxpayer Identification Number (TIN).

- Next, input your TIN and the registered Revenue District Office where you are registered. This information is essential for identification purposes.

- Provide your registered business address. This should reflect the official address associated with your tax records.

- In the 'Authorized Representative' section, specify the full name of the person who will act on your behalf.

- Detail the specific tax types and corresponding BIR form numbers that your representative is authorized to handle. For example, if authorizing for the Registration Fee, state ‘Registration Fee’ and the applicable BIR form number.

- Insert the taxable period for which this authorization is granted. This designates the specific timeframe covered by the authorization.

- Sign the document where indicated, ensuring your printed name is clear underneath your signature.

- Review all entries for accuracy and completeness before finalizing the document.

- Once completed, you can save the changes, download the document for printing, or share it as needed.

Complete your Authorization Letter To Process Bir Documents online and ensure your tax matters are handled efficiently.

In writing a letter of authorization to claim on your behalf, start by clearly stating your own name and the name of the person you are authorizing. Clearly outline what they are authorized to claim, and add relevant details to avoid confusion. Signing this letter will ensure it acts effectively as your authorization letter to process Bir documents.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.