Loading

Get Real Property Recordation And Transfer Tax (form Fp 7/c) - Otr - Otr Cfo Dc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Real Property Recordation And Transfer Tax (Form FP 7/C) - Otr - Otr Cfo Dc online

Filling out the Real Property Recordation and Transfer Tax (Form FP 7/C) online can be a straightforward process with the right guidance. This guide will provide you with step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the form correctly.

- Click the ‘Get Form’ button to access the form and open it in your preferred digital editor.

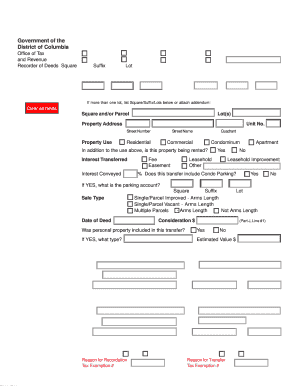

- Begin with Part A, selecting the type of instrument being recorded. Choose from options like 'Deed', 'Tax Deed', 'Easement', and more, as appropriate for your transaction.

- In Part B, provide the property description. Fill in the square, lot, and address details. If more than one lot is involved, list all relevant square/suffix/lots or attach an addendum.

- Continue to indicate the property use (e.g., residential, commercial) and whether it is being rented.

- Complete the interest transferred section, specifying details like fee, easement, or leasehold.

- In Part C, enter the contact information for the person submitting the instrument, including name, firm, and address.

- Proceed to Part D, where you will input who should receive the returned instrument and their contact details.

- In Part E, check the appropriate boxes to indicate any tax exemptions applicable to your situation.

- Part F requires notification information related to homestead or low-income tax exemptions, if applicable.

- In Parts G and H, provide the grantor and grantee information, respectively, ensuring that all names and addresses are accurate.

- Part I asks for the mailing address for the grantee, which may differ from the information in Part H.

- For Part J, calculate the consideration and financing details, completing all items accurately.

- Complete Part K with the tax computation based on the provided consideration figures.

- Read the affidavit in Part L carefully, then provide your signature and the date, along with the signatures of any additional grantors or grantees.

- Once all parts are filled, review the form for accuracy, then save your changes and consider downloading or printing it for your records.

Start completing your documents online today for a smoother filing experience.

Deed Recordation DC Code Citation: Title 42, Chapter 11. 1.45% of consideration or fair market value on the entire amount, if transfer is $400,000 or greater.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.